‘Old School’ stocks lead the gain as the ASX hits new post CV-19 highs (JHX, TNE, APX)

WHAT MATTERED TODAY

A good session for the local stocks buoyed by the +900pt rally on the Dow overnight, however rallies in US stocks of that magnitude haven’t necessarily translated to strong / sustained gains for the local bourse in recent times. We seem to be leading rather than following the US, although they do generally trump the magnitude of our moves on the upside.

Still, today was a reasonable session, we gave back a touch of the early optimism (-46pts from the morning highs) however some sectors kept their foot to the floor. Energy led the way adding +4.21% while we’re also starting to see ‘Aussie Economy’ stocks doing well, by that I mean building materials (Adelaide Brighton +7.5%), construction (Lendlease +4.95% ), construction / mining services (NRW Holdings +5.25%), property (Stockland +6.03%) and even the retail landlords (Vicinity +6.92%, and Scentre Group +7.69%) all doing well. Materials were also strong led by Iron Ore miners RIO +4.67%, Fortescue +4.44% & BHP +5.89%, the latter obviously benefitting from its exposure to oil which has rallied strongly, the talk of storage capacity and negative futures pricing banished from the headlines.

We’ve been discussing the theme of growth v value in recent notes and the potential for the focus to swing back into the more boring value orientated stocks, the theme showing some signs of playing out overnight (Dow Jones +3.85% v Nasdaq +1.96%) and the same played out today, Afterpay (APT) -0.73% versus old school packaging business Pact Group (PGH) +5.39%. Growth has had a phenomenal run and its understandable why, however as we often say, elastic bands can only stretch so far and we might be seeing the early signs of exhaustion.

I was in the office today and traffic is starting to build back up in Sydney, the trip from Balgowlah Heights to the city at 6am was getting close to usual traffic + there was more people around about the city today as we move slowly back towards normality, schools back full time in NSW on Monday will be a big change, my youngest can’t wait, my eldest can.

Overall, the ASX 200 added +99pts / +1.81% today to close at 5559 - Dow Futures are trading down -7pts/-0.03%.

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE:

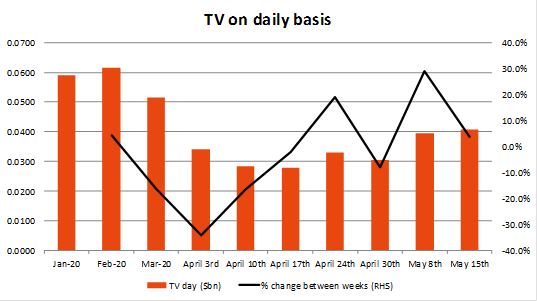

Tyro Payments (TYR) -2.29%: I missed putting this in yesterday however below is the weekly payment stats from the payment provider we’ve been using / writing about as one indicator that was signalling a bottoming / recovery in spending and last week saw more improvement. As we spoke about last Monday the turning point was in the week of April 17th and payment volumes are now 47% higher than that period. Tyro is one of the fastest growing technology terminal businesses in Australia with the bulk of their transactions in the hospitality and tourism space, hence is a good raw indicator of trends here.

Key takeout’s from our tech analyst at Shaw Jono Higgins.

· May 15th weekly TV of $409m a day, up 4% on the week prior and up 47% on same period last month;

· YoY growth now -20% in April, versus a low of -43% in April. Decline still there at ~-40-50% on previous growth rates YoY. However delta is positive; and

· Expect positive traction into EOFY. This is likely to be broadly supportive of businesses with a structural change and speciality retail/omni channel experiences.

Source: Shaw and Partners

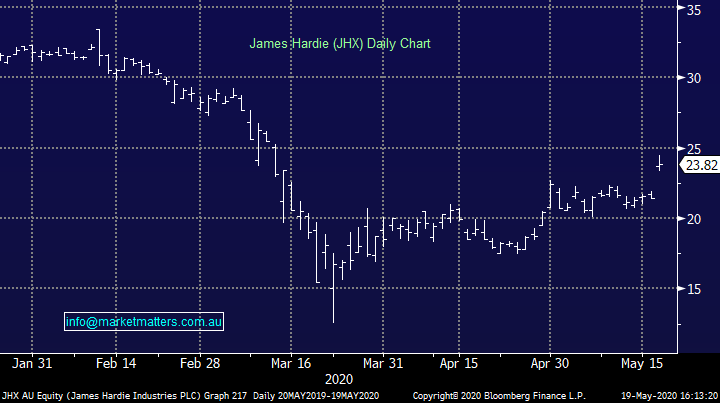

James Hardie (JHX) +11.2%: Reported full year results today that were a but better than expectations in terms of revenue and inline in terms of underlying operating profit (~$353m), however the commentary was upbeat. Hardies talked up the strong 12 months just gone and good momentum that continues, they said March volumes were good, cost outs going well and they were ultimately a lot more upbeat about the COVID-19 slowdown. They provided no guidance and scrapped the dividend however the underlying tone of the update was on the positive end of the spectrum. The market is bearish this stock, consensus implies a decline in earnings for FY21 of ~20% and it simply didn’t feel like the company was experiencing such weakness.

James Hardie (JHX) Chart

Technology One (TNE) -0.92%: the software as a service (SaaS) business announced first half results today with profit up 6% to $19.1m after tax, helping lift the interim dividend 10%. The company builds business processes software for a range of corporates, government divisions and education providers to name a few. The ongoing subscription like fees collected for their offering generates more than 85% of revenues helping maintain the stability of earnings through the pandemic. With their software enabled for a work-anywhere approach, the Chairman making key mention of the streamlined nature of the set up highlighting the benefits of a “true digitally enabled solution.”

The push into the UK is the main growth frontier for TNE at this stage, with the new geography posting a small loss for the period of $800k, though this was down from a bigger loss in the 1st half last year. Given the evolving situation, the company guided to pre-tax profit growth of 8-12% with the market already pricing in the top end of the range. TNE offers a great product in an industry with years of growth ahead of it. The stock looks a little punchy here, though one to keep an eye on into any weakness.

Technology One (TNE) Chart

Appen (APX) +0.20%: hosted a technology day today, inviting the market for a closer look at the company’s AI offering and the opportunities that exist for it. Back in April, APX re-confirmed EBITDA guidance for the full year of $125-130m though they sighted a key factor that would boost the performance could be a weak AUD. Since then the Aussie battler has moved higher and looks set to press on if the commodity tailwind remains. Back to Appen though, the company didn’t announce anything new to the market, more just an education day for investors talking to the basics of building out a data set through to the scalability of the technology. A great company, but may struggle in the face of a higher Aussie dollar as well as slowing digital marketing spend or reduced interactions lowering the rate of data-collection.

We like, but would be buyers at lower levels.

Appen (APX) Chart

BROKER MOVES:

· Perseus Raised to Buy at Citi; PT A$1.40

· Dacian Gold Raised to Speculative Buy at Canaccord

· Ramsay Health Cut to Sell at Morningstar

· Elders Cut to Hold at Morgans Financial Limited; PT A$10.20

OUR CALLS

No changes to portfolios today.

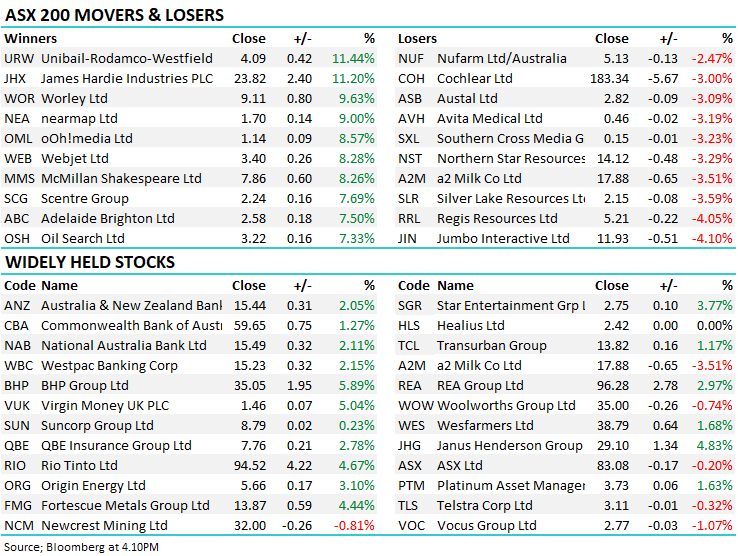

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.