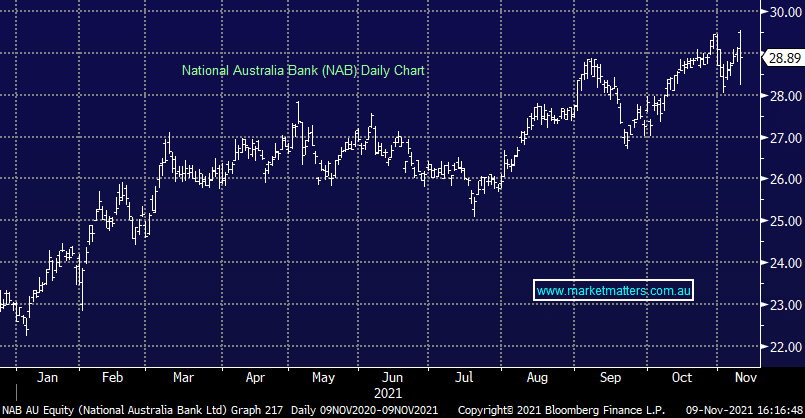

NAB reports FY21 result, shares track lower

NAB -0.76%: The 3rd and final of the Big 4 banks to report FY21 results today with NAB confirming a very strong bounce back post COVID with cash earnings up 38.6% to $6.558b – a slight beat to market expectations while the 67cps dividend was also a beat, taking the full year dividend to $1.27. Capital levels are also very strong with a CET1 capital ratio of 12.25% which well above the APRA 10.5% ‘unquestionably strong’ threshold. There is also a $2.5b share buyback underway, with $2.0b remaining, so why was the stock down? Markets and treasury income declined by $228m in the second half – resulting in net operating income reducing from $8,884m in FY20 to $8,367m in FY21. Net interest margin also declined from 1.78% to 1.69% (FY21 v FY20) with NAB expecting a similar number in FY22 before a recovery in FY23. All in all, a strong recovery however that half of half trajectory has softened and margins are still under pressure.