Materials bounce with tariff news, when will CSL find support (CSL)

WHAT MATTERED TODAY

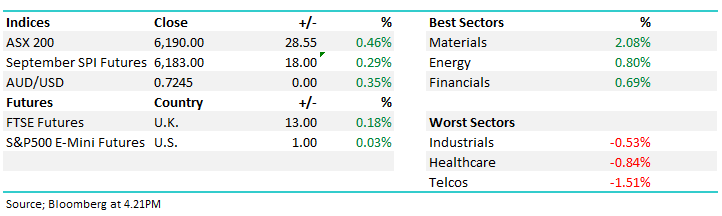

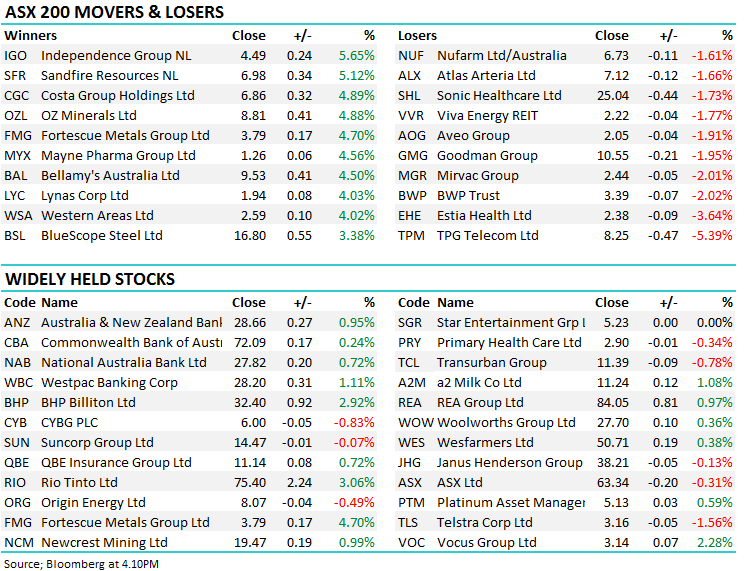

The market clawed back yesterday’s losses as Mr Trump surprised the market with a softer than expected first Tariff blow on China. Traders feared the worst heading into the announcement with the gloomiest predictions at 25% on $US 200b of Chinese goods, but Trump imposed a 10% tariff as a start, delaying the 25% out to 2019 if China fails to negotiate over the issue. As a result there was buying of the emerging markets, base metals and resources were strong helping materials catch a bid as markets took on some risk.

Telcos were dragged lower by TPG on fear mongering around the market of the possibility the TPG-Vodafone merger falls over, while CSL continued to weigh on healthcare – we speak about this market darling later in the piece.

Westpac was the best bank today as their lending rate hike came into force. This was coupled with a drop in marketed rates for new borrowers in an effort attract new customers – something the banks find notoriously hard to do. The market enjoyed the news, and any headway into gaining extra market share will serve them well. The market is only looking for small, incremental growth numbers from the big four – which should be achievable i.e. expectations remain low.

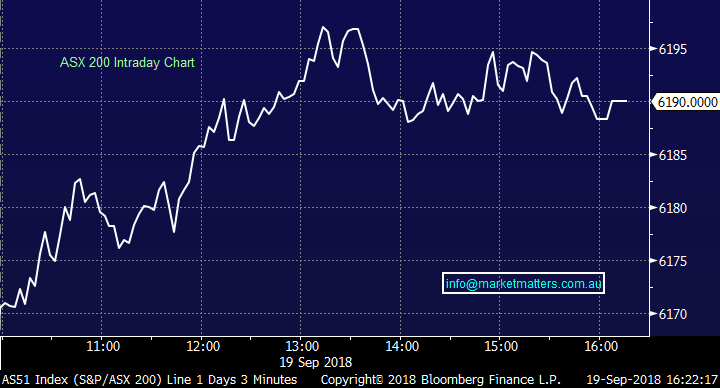

Overall, the index closed up +28 points or 0.46% today to 6190. Dow Futures are currently trading up 41pts/0.16%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

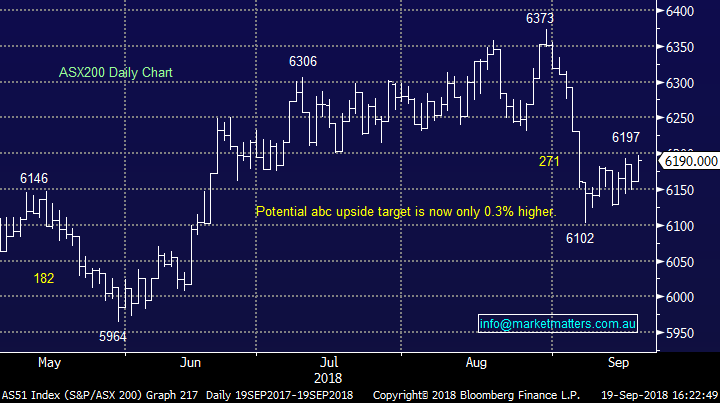

Broker Moves; Macquarie took a knife to aged care stocks today, an early mover ahead of the pending Royal Commission and subsequent regulations. The three names resumed their selling after seeing some relief yesterday – in our view it was a good opportunity to let stock go with a small bounce and some solid volume. Today Estia (EHE) –3.64%, Japara (JHC) –6.69% & Regis (REG) –1.63%.

Japara Healthcare (JHC) Chart

RATINGS CHANGES:

· Kathmandu Downgraded to Hold at Canaccord

· Estia Health Downgraded to Neutral at Macquarie; PT A$2.70

· Japara Downgraded to Underperform at Macquarie; PT A$1.33

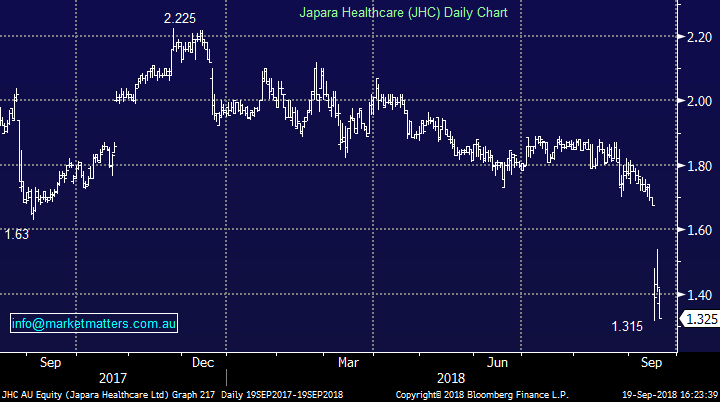

CSL $202.49 / -1.36%; Plasma company CSL has been soft in September coming under pressure amid some profit taking in the recently strong growth area of the market. CSL is now down 13% from its all-time high in early September, including a touch over 1% today – although this is still above where the stock was trading at the beginning of August and doesn’t take into account the $1.27 dividend paid last week.

The question remains, why has the biotech stock come back so aggressively in a market that has been relatively stable? CSL currently trades on a PE of 33.1x, which isn’t all that stretched for healthcare or growth stocks if we look globally. It reached a high of 37.4x not long ago, but it is still ~30% above its historical average of 25x. The stock rerated over the past couple of years as it has been achieving huge growth, justifying a higher PE. Over FY18, earnings grew ~30% - a juicy number and companies with that kind of growth would generally trade closer to 40x than 20x earnings.

So what price do you pay for CSL? Looking forward, earnings are now forecasted to grow at around 14% for FY19, steadily easing over the outer years to around 11.5% in FY22 – according to Bloomberg consensus. These are still great numbers, no doubt about it however low double digit growth and a proven track record of meeting expectations will mean investors are happy to pay a higher multiple. But these numbers are less than half the growth the company was achieving when the market was paying 37x. With circa 12% growth over the foreseeable future, CSL certainly deserves to trade on a solid multiple, but 37x is too high in our view. On 25x forward earnings, which is its 5 year average, CSL is worth $156. A P/E of 30 equates to $180 a share.

CSL Chart

OUR CALLS

We removed the BENPG from the Income Portfolio today ahead of the NB Global Corporate Income Trust which lists on 26th September.

Have a great night

James / Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 19/09/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.