Australian Investment Blog

ASX:TPM 18/09/2018

TPG (ASX:TPM) shows growth in tough conditions for FY18 result

Stock

TPG Telecom (ASX:TPM) $8.69 as at 18/09/2018

Event

TPG’s full year result hit the boards pre-market and while the numbers looked inline to a slight beat, the market sold it off initially largely on the downbeat commentary provided by the company, however the stock has rallied back from early falls of ~-4.8% to now trade around flat for the day. The telco has been facing the same problem as many others in the crowded Australian broadband market – margin pressure as customers move onto the nbn – however they still managed nearly 1% EBITDA growth over the year, while also printing well above the twice upgraded FY18 guidance. They gave guidance of FY19 EBITDA of $800M-820M, above the market’s current expectations of $800m.

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

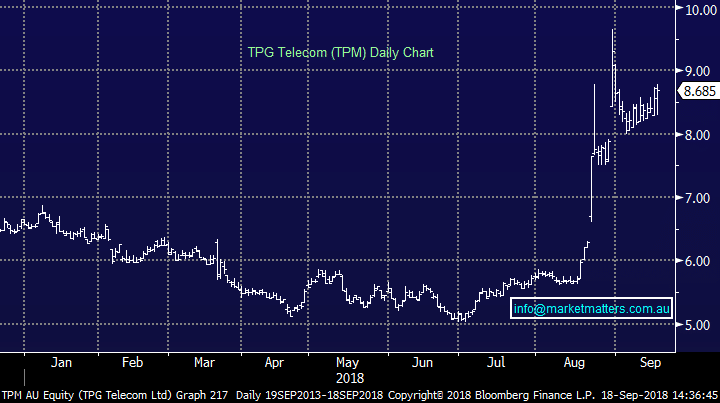

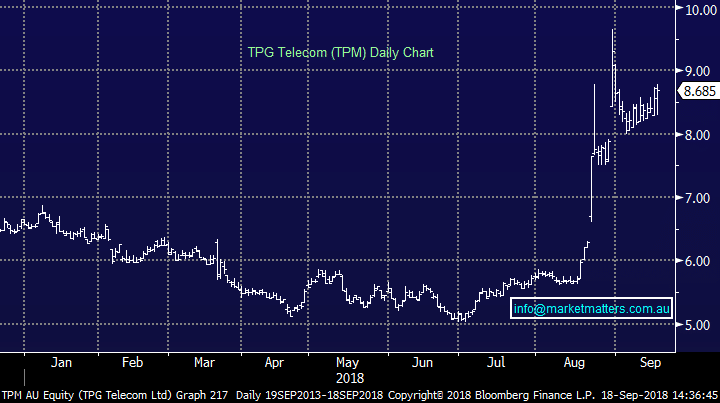

TPG Telecom (ASX:TPM) Chart

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (ASX:TPM) Chart

Market Matters Take/Outlook

There is a lot of optimism built into TPG with the expected merger with Vodafone. The result is good while ASX:TPM is getting the good end of the stick in the ‘merger of equals’ however recent price action keeps us at bay for now.

Relevant suggested news and content from the site

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (ASX:TPM) Chart

The next catalyst will likely be the progress of the merger with Vodafone, with the combined business tackling broadband, fixed and mobile services. The deal still has a few hurdles to jump through, the biggest being the ACCC approval, however it does signify the potential consolidation of telcos.

TPG Telecom (ASX:TPM) Chart