Is value appearing in AMP?

Stock

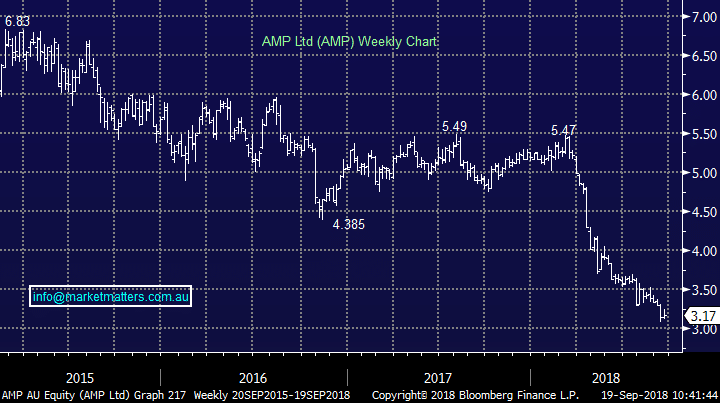

AMP $3.17 as at 19/09/2018

Event

It’s hard to argue that AMP is not cheap, whether it be relative to peers or relative to its own history. The price has fallen from a 12 month high or ~$5.50 to languish at $3.17 – a ~40% decline.

Turning back the clock, between 2013 and 2016 AMP garnered enough support to attract a decent premium to its peer group which is shown by the white line (AMP) being above the orange line (peers) and also by the second segment below being red, flagging it as expensive. By 2016 the shine was coming off and AMP was back to a sector average before gradually sliding lower ahead of the Royal Commission this year, which ultimately saw the price fall off the cliff, making it about two standard deviations cheap as shown by the green shaded below. AMP relative to its peer group Source; Bloomberg

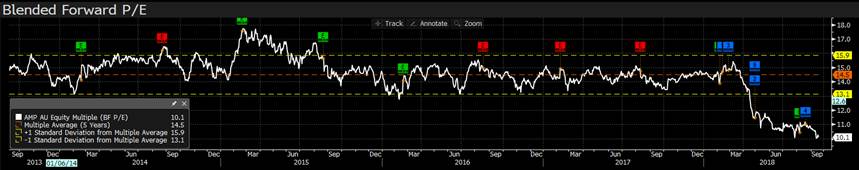

Looking at AMP versus its own history tells a similar story, as you’d expect. Over the past 5 years its traded on 14.1x which is a bit below the market average but reasonable. The range between 2015 and 2018 was 13x at the low and 16x at the high and it ticked between those levels. Buy it on a PE of 13x and sell it on a PE of 16x was the trade. The share price followed suite tracking between ~$4 & ~$7 over that period. Right now AMP trades on 10x earnings making it about 40% cheap versus its peer group and about the same relative to its own history. Clearly it’s a BUY - right?

Source; Bloomberg

Looking at AMP versus its own history tells a similar story, as you’d expect. Over the past 5 years its traded on 14.1x which is a bit below the market average but reasonable. The range between 2015 and 2018 was 13x at the low and 16x at the high and it ticked between those levels. Buy it on a PE of 13x and sell it on a PE of 16x was the trade. The share price followed suite tracking between ~$4 & ~$7 over that period. Right now AMP trades on 10x earnings making it about 40% cheap versus its peer group and about the same relative to its own history. Clearly it’s a BUY - right?

AMP’s historical PE bands

Source; Bloomberg

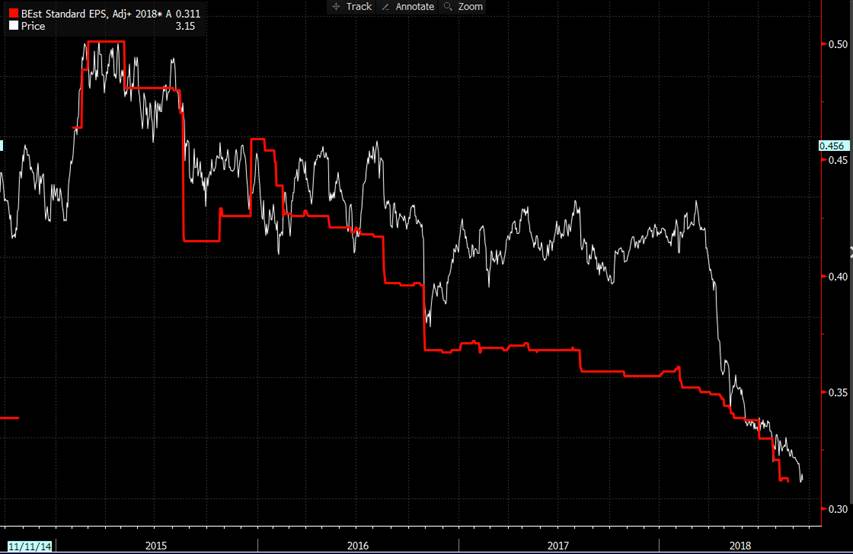

The multiple however, is only one piece of the puzzle. Getting the earnings side right is the more complicated part, particularly given the number of variables thrown into the mix post Royal Commission. If we look at the graph of consensus earnings expectations, it’s clear that analysts have been working hard to downgrade AMP earnings from 2014 – which was when earnings peaked and so did the PE at around 17 times. Since then it’s been a slow deterioration in both earnings and share price to ultimately end up where it is today trading on a PE of 10.1x and a price of just $3.17

Source; Bloomberg

The multiple however, is only one piece of the puzzle. Getting the earnings side right is the more complicated part, particularly given the number of variables thrown into the mix post Royal Commission. If we look at the graph of consensus earnings expectations, it’s clear that analysts have been working hard to downgrade AMP earnings from 2014 – which was when earnings peaked and so did the PE at around 17 times. Since then it’s been a slow deterioration in both earnings and share price to ultimately end up where it is today trading on a PE of 10.1x and a price of just $3.17

Source; Bloomberg

Ultimately, analysts will capitulate on this stock and cut hard, simply because they’ll get sick of being incremental about their assumptions. Assuming that happens, we could then look at AMP as a buy. We’ve seen a few do it already with our guy at Shaw and Partners along with Bell Potter cutting hard, and being bearish outliers with their price expectations – we think the rest will ultimately follow.

Source; Bloomberg

Ultimately, analysts will capitulate on this stock and cut hard, simply because they’ll get sick of being incremental about their assumptions. Assuming that happens, we could then look at AMP as a buy. We’ve seen a few do it already with our guy at Shaw and Partners along with Bell Potter cutting hard, and being bearish outliers with their price expectations – we think the rest will ultimately follow.

Source; Bloomberg

There are still a significant number of headwinds facing AMP largely around grandfathered commissions, the buyer of last resort (BOLR) facility that it has standing with its planners and of course potential restructuring charges, class actions and fines.

If they end grandfathered commissions like Westpac has done for their salaried planners it could costs them around ~$250m pre-tax according to Shaw. To give that number some context, it’s about 25% of the forecasted FY19 pre-tax profit.

The BOLR facility is an interesting one, and potentially a significant unfunded liability for AMP. These arrangements provide for a financial planning practice to receive a payment of 4 times the revenue of that practice from AMP. If we assume the average payment per planner is $1M then the potential liability for AMP is $1.5B. It seems that AMP has no material excess capital so an impost like this would probably result in a capital raising and/or lower dividends.

The other key to all of this is around adviser numbers which underpins distribution. What adviser / planner will move to AMP given all the negative publicity? It seems to us they’ll find it very hard to grow their planner base plus it will be difficult to retain existing. The industry is also facing greater educational requirements in the next few years which will require many to undertake further study. Combining all of the above, the 4 times revenue paid by the BOLR facility is suddenly looking pretty good!

Source; Bloomberg

There are still a significant number of headwinds facing AMP largely around grandfathered commissions, the buyer of last resort (BOLR) facility that it has standing with its planners and of course potential restructuring charges, class actions and fines.

If they end grandfathered commissions like Westpac has done for their salaried planners it could costs them around ~$250m pre-tax according to Shaw. To give that number some context, it’s about 25% of the forecasted FY19 pre-tax profit.

The BOLR facility is an interesting one, and potentially a significant unfunded liability for AMP. These arrangements provide for a financial planning practice to receive a payment of 4 times the revenue of that practice from AMP. If we assume the average payment per planner is $1M then the potential liability for AMP is $1.5B. It seems that AMP has no material excess capital so an impost like this would probably result in a capital raising and/or lower dividends.

The other key to all of this is around adviser numbers which underpins distribution. What adviser / planner will move to AMP given all the negative publicity? It seems to us they’ll find it very hard to grow their planner base plus it will be difficult to retain existing. The industry is also facing greater educational requirements in the next few years which will require many to undertake further study. Combining all of the above, the 4 times revenue paid by the BOLR facility is suddenly looking pretty good!

KEY POINTS

- AMP is now extremely cheap relative to history - However, significant earnings risk remains in the stock, and earnings will likely be under pressure for some time - The BOLR facility could be a significant unfunded liability MM has no interest in AMP as an income play – yet AMP Chart