Market drifts lower – yield stocks weigh (TWE)

WHAT MATTERED TODAY

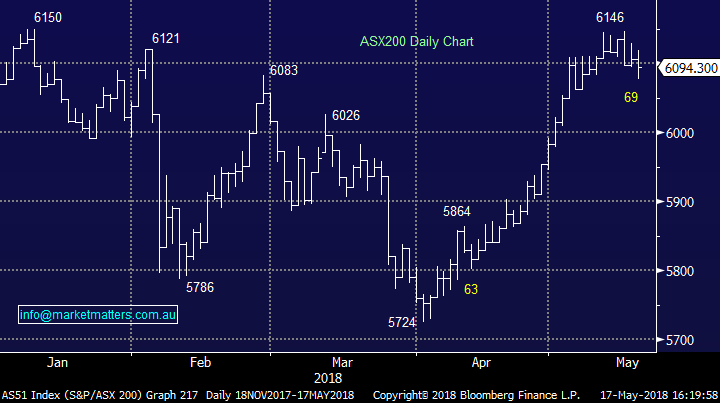

The market rolled over early this morning on some big volume through the futures market before ebbing and flowing throughout the session. A whimper up into the close but nothing to write home about, the market simply feels a little hot now and needs to some time to cool – sort of like property markets as discussed this morning but (hopefully) in a shorter time frame. Yield stocks came under pressure today – expected really given the rise in US interest rates overnight with the 10 years cracking above 3.11%. A trend we think will continue!

Overall, not a lot on the docket today with the market finishing down -12pts or -0.21% to close at 6094.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

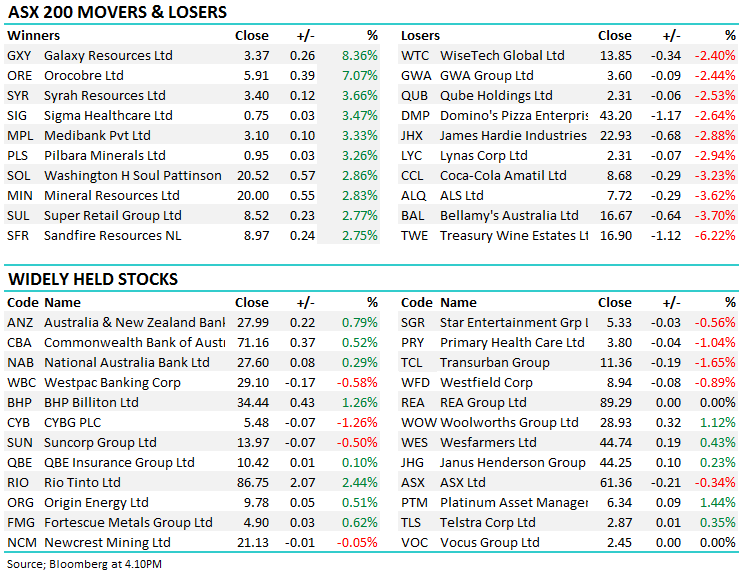

Broker Moves; ANZ is fast becoming the bank of choice after they reported well + showed a sector leading capital position. If you hold banks income, ANZ seems the prime candidate for better returns in the coming 12 months, although the share price has now moved in line with that view as discussed in the Income Report yesterday.

Brokers reasonably active…

- ANZ Bank (ANZ AU): Upgraded to Outperform at Credit Suisse; PT A$30

- Automotive Holdings (AHG AU): Upgraded to Buy at Morningstar

- Bapcor (BAP AU): Downgraded to Hold at Morningstar

- Crown Resorts (CWN AU): Cut to Neutral at JPMorgan; Price Target A$13.50

- Doray (DRM AU): Upgraded to Buy at Argonaut Securities; PT A$0.41

- IOOF Holdings (IFL AU): Downgraded to Hold at Morningstar

- Macquarie Atlas (MQA AU): Cut to Equal-weight at Morgan Stanley; PT A$6.36

- NAB (NAB AU): Downgraded to Neutral at Credit Suisse; PT A$29

- Sydney Airport (SYD AU): Cut to Equal- weight at Morgan Stanley; PT A$7.27

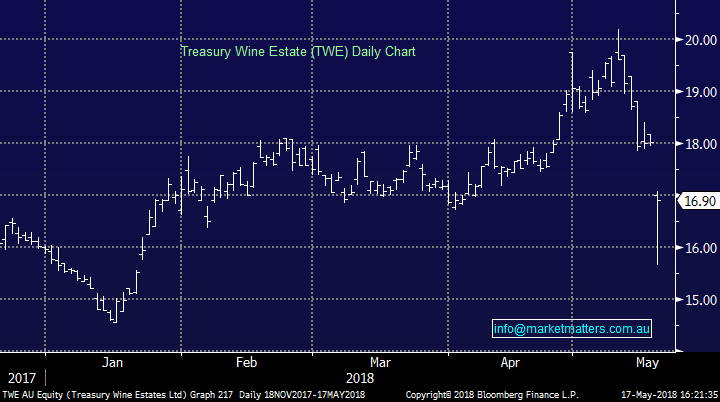

Treasury Wine Estates (TWE) $16.90 / -6.22%; soft today following some news flow this morning regarding inventory levels in China. China has been one of the biggest growth areas in wine globally, and TWE has targeted this market successfully – one of the many factors that underpinned the share price rally in recent times - shares went from sub $5 in 2015 to over $20 recently. A glut of supply suggests that wine is being imported faster that it can be drunk and imports will have to slow down, or stock sold at a discount. Although Treasury discredited this view in an announcement before the market opened, they did note that exports to China have been delayed by customs, which is not expected to be a long term issue.

Treasury Wine Estate (TWE) Chart

OUR CALLS

No changes to the MM Portfolio’s today

Have a great night

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 17/05/2018. 4.30PM

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports.

If you rely on a Report, you do so at your own risk. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.

To unsubscribe. Click Here