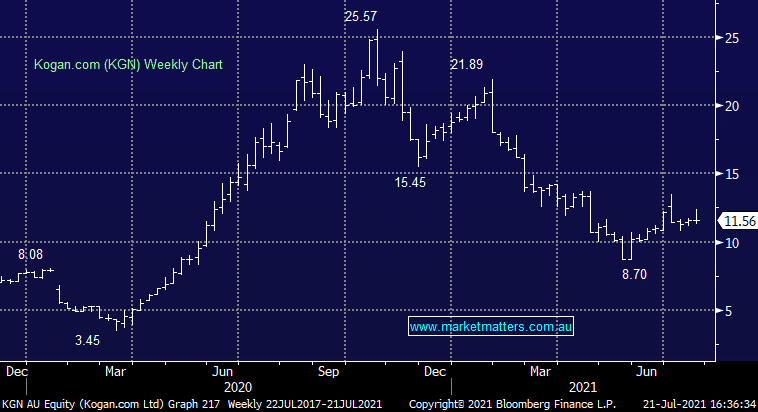

Kogan.com (KGN) shares slide after trading update

KGN -1.45%: shares in the online retailer slowly gave back a strong start to close lower today following what looked like a decent full year pre-announcement. Sales are expected to be up over 50% for the full year, and earnings up around 60% which puts it right in the middle of previous guidance, and a little ahead of where the market was positioned. Earnings in the second half were weighed by increased costs following some inventory overhang – higher warehouse costs and more discounting hit margins after they got too bullish & bought a heap of inventory. This had been well flagged and today’s announcement showed signs that the issues are starting to subside. Active customers fell marginally in the quarter, from 3.22m to 3.21m by year end – I’d call that a win given the doomsayers calling for a huge reversal in online spending as physical stores reopened. We will see the impact of the latest rounds of lockdowns at the full year result.