Sectors we do & don’t like as lower rates are trumping poor growth (RIO, CSL, RMD)

First and foremost, a massive congratulations to Ash Barty for a sensational French Open win – well done Ash – as the Betoota Advocate suggested, it has been confirmed that there may be a link between not carrying on like a pelican and having success on the tennis court!

Back to markets and the ASX200 rallied strongly on Friday gaining almost 1% with strong gains in all sectors except Retail. We are set to open strongly again this morning following 2 sessions of solid gains on US / global markets that have seen the Dow rally over 1,500-points from last Mondays low of 24,680 – they love a dovish Fed. We like our statistics at MM and putting performance into simple perspective can be very useful, the average return of Australian stocks since 1900 is close to 12% including dividends, to-date in 2019 the ASX200 has rallied +20.3% before dividends, in other words taking a little $$ from the table into ongoing strength is starting to make sense.

Last week we saw the Dow surge +5.6% from its Monday low as investors jumped back onto the rate cut bandwagon with many now looking for 3 cuts in 2019, amazingly the US market had a major “hissy fit” only back in the last quarter of 2018 on concerns the Fed would raise interest rates too fast sending the country into a recession. Anyone who thinks that markets are an efficient machine should reread the previous sentence and look at the chart below which shows how the markets sentiment changed on the proverbial interest rate dime – the current market mindset is a weak economy is good for stocks because it means lower rates.

With markets very focused on the potential for lower interest rates investors are currently comfortable to exchange disappointing growth for the quick “rate” fix. As we said in Fridays “Direct from the Desk” we don’t believe its time to fight the tape but two obvious catalysts would probably change the markets “look and feel” very quickly:

1 – All markets trade / move in cycles including the current post GFC extremely low interest rate environment. When inflation finally raises its head we are likely to be discussing when the next rate rise will occur and we saw in late 2018 stocks don’t like rate hikes unless perceived underlying economic strength warrants it.

2 – Markets remain comfortable that the financial engineering by central banks will stave off a meaningful recession, if this confidence wanes rate cuts might not be enough for stocks.

MM is now mildly bullish the ASX200 expecting post GFC highs in the days / weeks ahead plus we remain bullish global equities for now.

Overnight US stocks traded up again although the Dow closed 150-points below its highs, the SPI futures are pointing to a strong opening following the Australian long weekend up ~60-points helped by BHP which closed up almost 50c in the US.

In today’s report we have again considered how to invest in today’s market which while not cheap is clearly attractive compared to bond yields.

ASX200 Chart

As we have touched on numerous time the ASX200 has been dancing to the bond yield tune and the below chart illustrates the action perfectly. We recently showed the below correlation calling stocks to again push higher following the 3-year bonds who had already made fresh highs – remember high bond prices means lower bond yields. This has now unfolded and bond prices have started to consolidate implying stocks are set for a rest.

Medium term the euphoria around falling interest rates feels pretty stretched with the likes of AMP calling the RBA Cash Rate down from todays 1.25% to 0.5% - its starting to feel like the room for surprise / disappointment is on the upside for interest rates. At MM we feel the RBA will cut rates to 1% later this year and then sit back and observe the impact on our economy and of course housing prices.

MM feels interest rates may remain “lower for longer” but believe the RBA will be very careful cutting rates significantly further.

ASX200 v Australian 3-year bonds Chart

The pure ASX200 index is languishing ~6% below its all-time high set in October 2007 but when you include the dividends it’s a whole different story with the Accumulation Index having rallied over 300% post the GFC to sit almost 60% above its 2007 level.

As the market continues to become more expensive by the week we believe stock / sector selection will become increasingly important. The below chart illustrates the importance of yield / compound interest to a portfolios long term performance and it’s an important component of our following thoughts around sector selection for 2019 / 2020.

MM remains bullish the ASX200 especially those offering sustainable yield.

ASX200 Accumulation Index Chart

Two sectors we like in the second half of 2019.

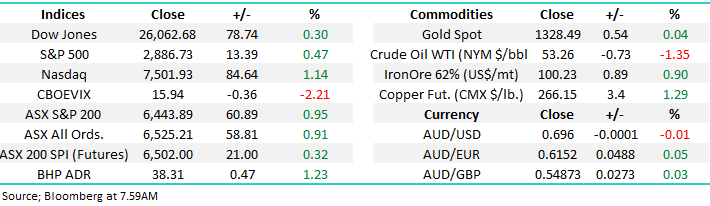

Below is a cross section of Term Deposits rates as at Friday morning, with different maturities which confirms that savers living off fixed interest are undoubtedly doing it tough, especially compared to plans that were made say a decade ago.

Source: Shaw & Partners Money Markets

The two sectors below make up the bulk of the Australian market and we believe both will pay solid dividends while offering some share price appreciation if we get the timing right.

1 Banking Sector

Fund managers have been caught underweight the Australian banking sector due to a few well publicised factors including concerns around bad debts from property to zero / almost no growth in the foreseeable future. However when consensus is so heavily positioned in one direction surprises often occur and in this case the longer the banks keep grinding higher the more fund managers will be forced to buy them creating a self-perpetuating rally.

We are overweight the sector and may consider taking a little $$ off the table into further strength but until we get any meaningful developments in the health of our economy yields like Westpac (WBC) 6.7% and Commonwealth Bank (CBA) 5.4%, both fully franked, are hard to ignore - we believe there’s a large number of investors / fund managers hoping to buy a pullback.

MM remains bullish the banking sector.

ASX200 Banking Sector Chart

2 The Resources Sector

The resource sector has significantly more diversity than the banks and the performances from stocks within the sector have more variance, however the below chart illustrates as a group they have enjoyed a strong 3-year advance now making stock selection more important than ever.

We like the dare I say it, boring large cap end of town at this stage of the cycle, which we believe has further to go primarily through the iron ore space. Iron ore has rallied above $100 a ton this year following a supply crunch after a Vale SA dam collapse combined with robust China demand to drive prices higher. In recent weeks we’ve seen broker upgrades to the sector which corresponded with a short term top in some of the miners, however the tailings dam issue which has impacted Vale is now an industry wide issue. More scrutiny on existing dams, and less chance of approvals for new dams makes meaningful new production unlikely plus it pushes out the time frames associated with the Vale ramp-up.

The “big 3” of the space BHP, RIO and Fortescue (FMG) have become huge cash generating machines which through special dividends have been yielding above the banks. All good things come to end but we believe iron ore will remain “higher for longer” suggesting further outperformance from the group.

MM remains a fan of the “big end of town” iron ore miners.

ASX200 Materials Index Chart

RIO Tinto (RIO) Chart

Two sectors we don’t like in the second half of 2019.

Not surprisingly these 2 sectors pay a fairly low yield and carry high valuations. We have a low exposure to both of these groups and anticipate it will reduce still further in the weeks ahead.

1 ASX200 Healthcare Sector

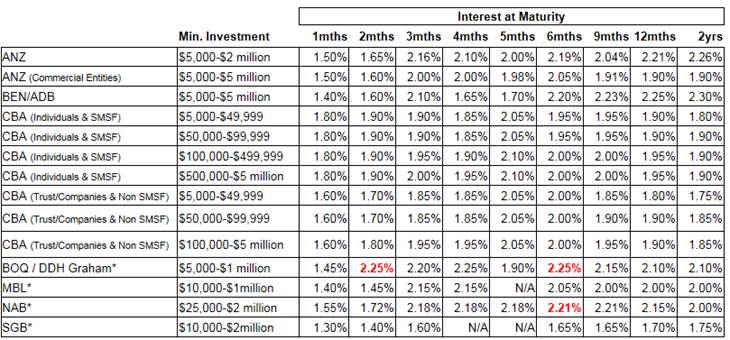

The Healthcare sector has enjoyed a phenomenal run since the GFC but we are seeing some definite cracks starting to form. Interestingly, while the ASX200 is poised to make fresh post GFC highs this morning the Healthcare stocks remain ~8% below the same milestone. In our opinion the aggressive 22% correction from last Septembers high was a warning of underlying valuation issues within the sector.

When sector and market stalwart CSL can tumble almost 26% in a few months its conveying a message we should not ignore i.e. the market is no longer prepared to pay large valuations for the sector. CSL is still treading on an Est. P/E of 33.6x while yielding only 1.23% and in our opinion it simply is no longer attractive from a risk / reward perspective.

MM expects the Healthcare sector to underperform in 2019 / 2020.

ASX200 Healthcare Sector Chart

CSL Limited (CSL) Chart

MM has been long ResMed (RMD) since its panic sell off earlier in the year targeting a break to fresh all-time highs which should occur this morning following strong gains in the US. The pleasant quandary now is where to take some $$ from the table, the position looks set to be up ~30% this morning, as knowing / guessing how far a market will pop into fresh highs is always a tough game. However we recall famous investor Baron Rothschild at times like this:

“I never buy at the bottom and I always sell too soon.” – Baron Rothschild.

MM is looking to take profits from our RMD position into fresh all-time highs.

*Watch for alerts.

ResMed (RMD) Chart

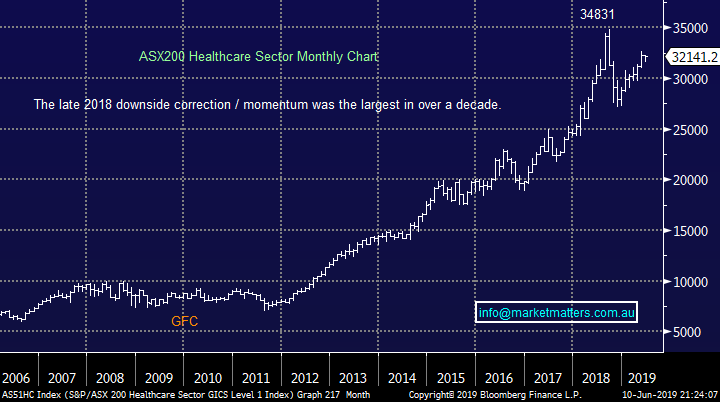

2 ASX200 Software & Services Index

The WAAAX stocks which drive this sector (Wisetech, Appen, Afterpay, Altium and Xero) have soared in recent years but investors should not forget the warning shot that high value stocks received in late 2018, it illustrated perfectly that when investors / momentum followers no longer hear the music they run for cover very quickly. Our problem is the amount of optimism build into current prices is high, and while the sector is about growth in users / customers rather than profits the reality is, growth at some point needs to drop into earnings.

GARP (Growth at a realistic price) as opposed to GAAAP (Growth at any price) is how we like to invest at MM and at current levels we believe fundamentals are being forgotten within the group pushing the stocks well and truly into GAAAP territory. In part due to the lack of alternatives our high-growth stocks are the most expensive in the world which brings with it significant risks. While stocks within the sector must be considered individually when the group does correct, and it may well be from higher levels, the likelihood is all will come down hard.

**Interestingly, APT is set to launch a capital raise this morning while loan provider Prospa Group (PGL) is set to list at midday in what was a pretty well bid IPO**

MM has no interest in our IT sector at current valuations seeing better opportunities in the US.

ASX200 Software & Services Index Chart

Conclusion (s)

At current levels MM prefers the banks / large cap resources over the Healthcare and IT sectors.

Global Indices

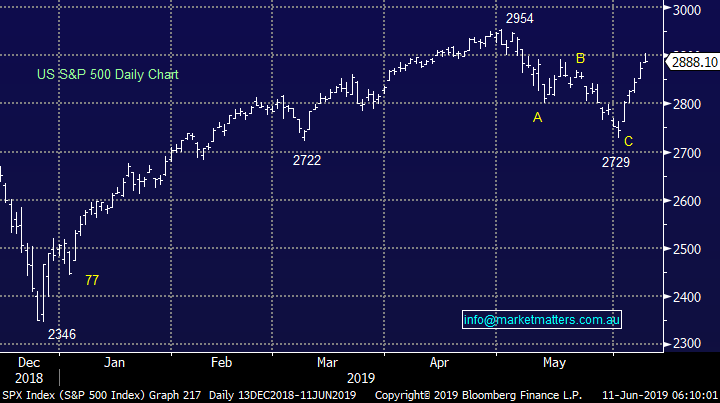

Nothing new with our preferred scenario the recent pullback was a buying opportunity although we are initially only looking for a test of / slight new 2019 highs from US indices.

The fresh dovish stance by the Fed has helped the S&P500 get within 2% of its all-time high, perhaps some positive news from this month’s G20 meeting between the US & China on trade will create the market optimism for a test of the psychological 3000 area.

US S&P500 Index Chart

No change again with European indices, we remain cautious European stocks but the tone has improved recently and fresh highs in 2019 look a strong possibility.

German DAX Chart

Overnight Market Matters Wrap

· Risk has definitely been put back in place in investors’ eyes over the long weekend following a trade agreement been made between the US and Mexico. The focus turns back to US and China with US President Trump threatening to raise further tariffs should China President Xi not meet.

· Bonds sold off from recent low levels, with US 10 years backing up to 2.14% from last week’s low levels of 2.05%.

· Commodities were mixed with crude oil weaker (-1.35%) on reports that Russia and Saudi Arabia have yet to agree on extending current supply cuts.

· BHP is expected to outperform the broader market after ending its US session up 1.23% from Australia’s previous close.

· The June SPI Futures is indicating the ASX 200 to play catch up with the US and open 56 points higher to test the 6500 level this morning.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 11/06/2019

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report not withstanding any error or omission including negligence.