Ethical investing is gaining momentum (JIN, PME, WHC, TSLA US, SGR, COKE US, CWY)

Yesterday the ASX200 struggled in the morning before turning at midday and improving throughout the afternoon, a pretty common characteristic of this impressive post GFC bull market. The index finally closed down only 5-points with recently high flying CBA a major drag on the day falling over $1.50 following the announcement of a $300m capital raising by Bendigo & Adelaide Bank (BEN), no great surprise but it smelt like Australia’s largest and best performing bank became a funding vehicle i.e. fund managers sold CBA to pay for BEN.

While global markets continue to rally with the US & Europe leading the charge local stocks have been taking a breather as the much anticipated reporting season unfolds, we feel expectations are low and if things are just ok the ASX200 could easily pop towards our short-term 7200 target in the next fortnight. However some major companies are trading ex-dividend over the coming weeks which explains why the March Futures are trading around a 65-point discount to the underlying ASX200, in other words all else being equal the local index will decline by almost 1% into mid-March – don’t panic it’s just the usual index cycle as stocks pay their dividends.

Seasonally February is actually the second strongest month of the year for the ASX with an average gain of +3.2% over the last 10-years before investors lose interest in March / April and then run away in May / June. These swings are similar to the US but they make a degree of sense with regards to dividends – i.e. after a major portion of the index trades ex-dividend in Feb / March investors see less urgency to chase stocks, the dividends being received by shareholders supports the market in March / April before the phrase “sell in May & go away” gets banded around with increasing prevalence the more the markets rallied, often leading to a self-fulfilling pullback.

The domestic reporting season is set to gear up in a significant way this week, subscribers should anticipate some major action under the hood of the ASX

Reporting schedule available here: CLICK HERE

Results so far this AM:

BHP: Headline result in line, dividend slightly lower than expected at US65cps v US71cps expected

Emeco (EHL): All okay, revenue a tad below, profit a tad above, deleveraging remains a core focus, they talked up strong free cash flow generation expected in 2H and they also mentioned dividend, first time I’ve read that!

Sims Group (SGM): Expecting an underlying EBIT loss this half of $20-30m, they printed a loss of $23.2m, 6cps interim dividend and maintained guidance for the full year. Weak but no surprise

Cochlear (COH): Already downgraded last week although 1H profit still a little light on. They do have 2nd half skew so assuming consensus in 2H met, they will achieve midpoint of the downgraded guidance. Not a great result

Coles (COL): In line with expectations, dividend 1c above at 30cps

Altium (ALU): Out yesterday afternoon, was weak, meeting lower end of prior guidance, they generally beat so mkt will be disappointed

MM has increased our cash holding to 12%, we may do a little more if a suitable opportunity arises into strength.

Overnight US stocks were closed for Washington Day hence it’s no great surprise that the local index is poised to open unchanged this morning.

Today we’ve looked at how fund managers are restructuring portfolios in an ever-increasing ethical manner – investors need to know when they might be betting against the house.

ASX200 Chart

US equities were closed overnight hence they remain close to our target area for Q1 of 2020, for example the NYSE Index now sits less than 2% away. Technicals obviously don’t always correctly forecast equities but they do warn us when the risk / reward is becoming unattractive for the buyers and that’s exactly the current position in MM’s opinion.

MM is now neutral US stocks as they approach our Q1 target area.

US NYSE Index Chart

Jumbo Interactive (JIN) kicked off the week as the worst performing stock falling almost 7% in anticipation of a poor half-year result. The trend is clearly down for this on-line lottery company since their disappointing guidance to FY1 earnings, revenue is increasing but it doesn’t appear to be flowing through to bottom line growth. This is a growth stock with a reasonable fully franked dividend but at MM we want to see some results first, the share price is inferring all is not well.

MM has no interest in JIN just yet.

Jumbo Interactive (JIN) Chart

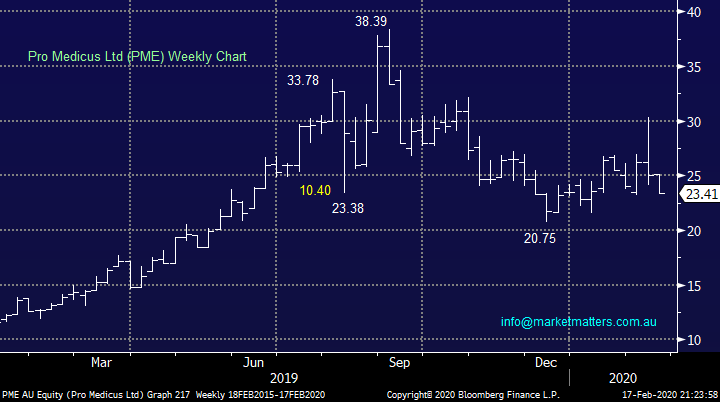

The second worst performing stock in the ASX200 on Monday was health imaging business Pro Medicus (PME) which fell almost -6.5% as investors appeared to digest last week’s 1st half results for 2020 – profits were up over 30% on the same time last year but it appears the market was expecting more, especially considering the current significant valuation on the shares.

MM still has no interest in PME.

Pro Medicus (PME) Chart

Sectors to be mindful of when investing as the investment landscape evolves

Its never exciting to start a report off by what to avoid as opposed to what to buy but not stepping on investment landmines and / or just major areas of significant underperformance is every bit as important as picking winners if you want your portfolio to outperform over time, one of the investment communities most famous quotes sums it up perfectly:

“Rule No. 1: Never lose money. Rule No. 2: Never forget rule No.1” – Warren Buffett.

When it comes to picking stocks / sectors that are likely to outperform there’s a new important variable on the block – Ethical Investing. Multiple expansion / increasing valuations has been driving equities higher over recent years but the opposite looks likely to wash through stocks / sectors sitting in the wrong bucket i.e. unethical sectors. Everybody has different opinions on ethics but today I’ve looked at the issue from a looming change in the supply / demand coefficient to stocks which crosses some investors “new no go line” as opposed to a particular view on the such issues.

I’m proud to say that Australia now has one of the highest levels of environmental, social and governance (ESG) investing and we believe this is a trend that’s probably only just getting started – easy to comprehend when we consider the weather patterns over just the last few years. Ratings agencies have developed scoring matrices for ESG products, an area which already boasts a massive ~$A45 trillion in assets.

Many fund managers now simply avoid stocks / sectors / products that don’t fit their ethical screen criteria leading to a dearth of buyers in certain spaces e.g. coal and which has garnered significant publicity over recent months as the world’s largest fund manager, Blackrock, has vowed to divest from fossil fuels creating a major seller, not just a reduced pool of buyers. Also, mid- last year Norway’s $US1trillion sovereign wealth fund announced it was going to sell its oil and coal assets, over $US8bn worth – a new trend is evolving. This is the dominant reason MM has not been bottom fishing with Whitehaven Coal, we believe its “new norm” from a valuation perspective will be lower and it’s hard to guess where investors will find it simply too tempting.

Whitehaven Coal (WHC) Chart

To put things in perspective, sustainability loan growth has increased by 8-fold since 2017 as banks become far more comfortable backing these styles of businesses. As is so often the way the US is dragging the chain with regard to responsible investing committing around half of Europe on a proportional basis, but this leaves plenty of room for catch up when the message finally gets through, probably post Trump!

Importantly companies with high ESG scores have generally been outperforming & we believe this will continue.

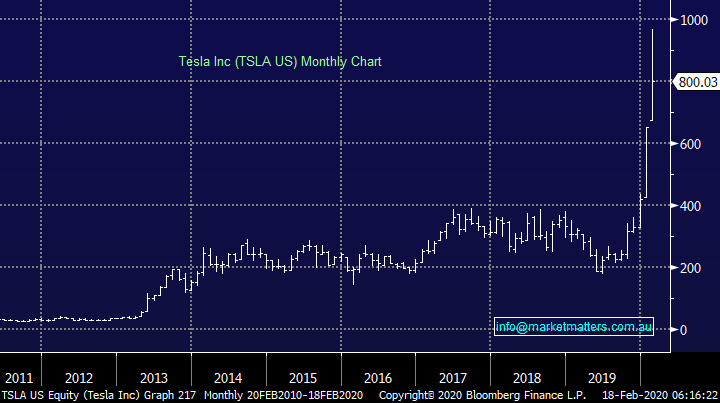

I couldn’t resist illustrating this trend with the below extreme chart of Tesla, lots of other factors at play here but Elon Musk’s company trades on huge valuation compared to other auto manufacturers although they’re also are looking to transition to electric vehicles (EV) albeit slowly in many cases.

Tesla (TSLA US) Chart

When I researched this subject in more detail, I was amazed to see Climate Change only coming in 4th in the list of most negatively screened issues, after weapons, tobacco and gambling. The first 2 have a minimal relevance to the ASX but we do have a few players in the gambling space, and they’ve had a relatively tough time recently, especially with the casinos being adversely impacted by the coronavirus.

MM believes Climate Change will eventually head the list but for now we must remain very cognisant that any investments in stocks whose footprint overlaps with these 4 is likely to have less fund managers considering such investments. Interestingly nuclear power comes in at number 8 but it arguably is a clean energy solution but of course a couple of major global disasters are unlikely to be forgotten by my generation – remember Fukushima which experienced a horrendous disaster back in 2011 but was operating past its “use by date”.

The ASX200 v Star Entertainment (SGR) Chart

Other sectors which get subjected to negative screening include alcohol, animal welfare, adult content, human rights and junk food. The latter is already seeing the progressive Scandinavian nations start to tax soft drinks, another trend we believe will accelerate as governments fight the cost of diabetes, the new replacement to cigarettes with regards to a massive cost to the health system.

At this stage looking at the performance of Coke my concerns around junk food appears premature – I guess Americans do live on the stuff!

US S&P500 Index v Coca-Cola Chart

The world needs to transition its energy sources asap in my opinion although depending on who you listen to climate change is not real, my thought is if there’s a chance, lets deal with it! The world is most definitely not moving as one when it comes to climate change which is a combination of beliefs and of course the desire to make a dollar. Below are some key issues to monitor as the likes of wind and especially solar become common place – I’m looking at a solar option for my house at present!

Oil & Gas – we’re seeing some major players exit assets and industry consolidation unfolding, this is likely to create some volatility and opportunity in the sector, but we will now be considering the space as short / medium term in nature.

Thermal Coal – an ever-increasing headwind is evolving for coal producers; the stocks will potentially become friendless high yielding cash cows that many funds won’t touch.

New energy & storage – a huge growth area than more traditional businesses, with potentially overlapping knowledge. We like companies like Bingo (BIN) which we hold in the MM Growth Portfolio and Cleanaway Waste (CWY).

ASX200 v Cleanaway Waste (CWY) Chart

Conclusion (s)

MM believes the trend of ethical investing is here to stay and should be increasingly considered in investment decisions moving forward.

Overnight Market Matters Wrap

- A quiet session across the globe as the US was closed in celebration for President’s Day, while the Euro region closed marginally higher following a wave of stimulus package being seen across the Asian region.

- Metals were higher on the LME, apart from aluminium, while crude oil continued to recover in quiet trade.

- A few big guns are due to report today – Abacus Property Group (ABP, Ansell (ANN), ARB Corporation (ARB), BHP, Cochlear (COH), Coles Group (COL), IOOF (IFL), Monadelphous (MND), Netwealth (NWL), Oz Minerals (OZL), Pilbara Minerals (PLS), Sandfire (SFR), Scentre Group (SCG), Senex Energy (SXY), Sims (SGM) & Virtus Health (VRT).

- The March SPI Futures is indicating the ASX 200 to open with little change at present as investors digest the big names reporting today.

Have a great day!

James & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.