Feels like a long 3 days…! (RIO, HLS)

WHAT MATTERED TODAY

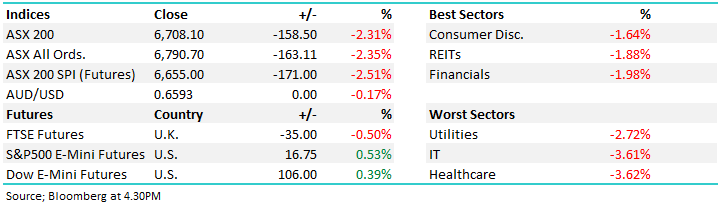

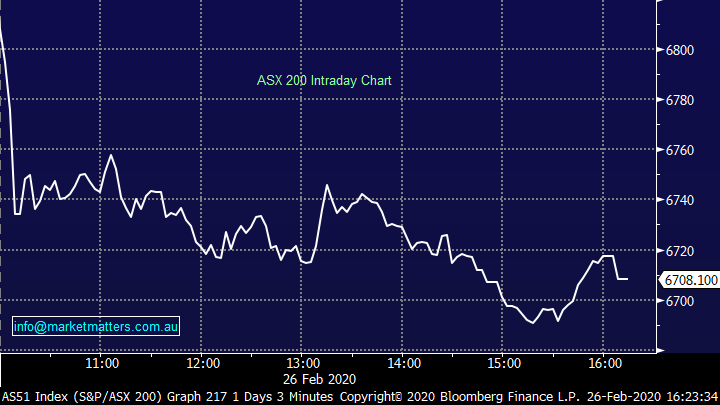

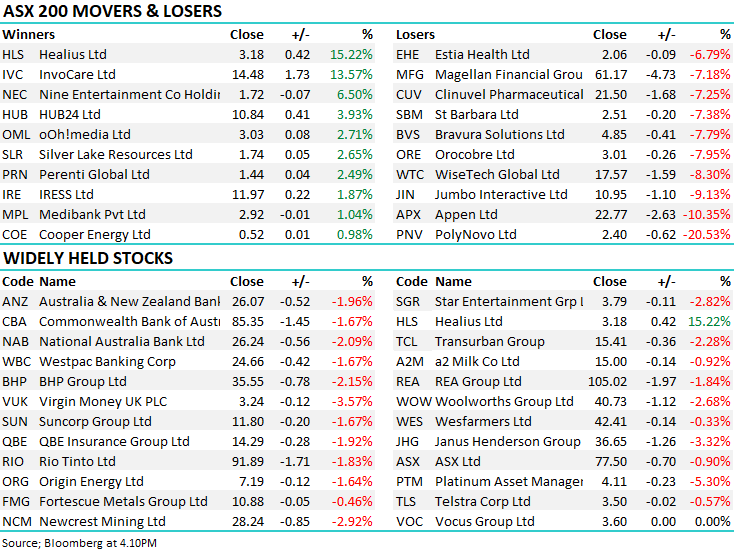

Markets hit again today, the ASX 200 down another -158pts / -2.31% taking the total decline from the 7197 high set last Thursday to -489pts / -6.8%, clearly an aggressive sell-off that has gone deeper / harder than we thought. Today it was the Healthcare sector that felt the brunt, however really it was simply board based selling throughout. 25 large caps fell more than 6.5% today, with AMA Group (AMA) and Polynovo (PNV) down by more than 20%. Not all bad news though with Healius (HLS) finally getting a bid, Invocare (IVC) was supported on a better outlook for deaths (hard to cheer that!) while Nine Entertainment (NEC) reported strong growth in its streaming services.

US Futures are trading higher by 0.47% at 4.39pm, however local investors clearly sceptical here given what transpired yesterday, Asian markets down today however again, the Chinese market was actually higher by +0.41%, Trump not having the same impact as Zi! Japanese stocks traded lower, down around 1% while Hong Kong shares lost around 0.5% following an announced US$15.4 billion stimulus package, which includes a HK$10,000 payment to each permanent resident of the city 18 or older.

Overall, the ASX 200 lost -158pts / -2.31% today to close at 6708 Dow Futures are trading up +120pts/+0.44%

I provided a quick video update to subscribers around lunchtime today – click here

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

Rio Tinto (RIO) -1.83%: Just out with Full Year results at 5pm this evening, with FY underlying profit of $10.37bn versus expectations of $10.28b (~1% beat) with underlying EBITDA coming in at $21.20bn, a ~1.6% beat to expectations. The dividend of $2.31 for the 2H is up from $1.80 a year earlier, however like BHP, they’ve slightly undercooked the 2H payout with the market expecting something nearer $2.50 – but splitting hairs really and full year payout ratio only 70% despite 1H19 special dividend, while gearing remains below their target range. In terms of guidance, it remains unchanged however they say that they’re currently evaluating the impact from coronavirus and it may have an impact on Q1. Looks a good result

Rio Tinto (RIO) Chart

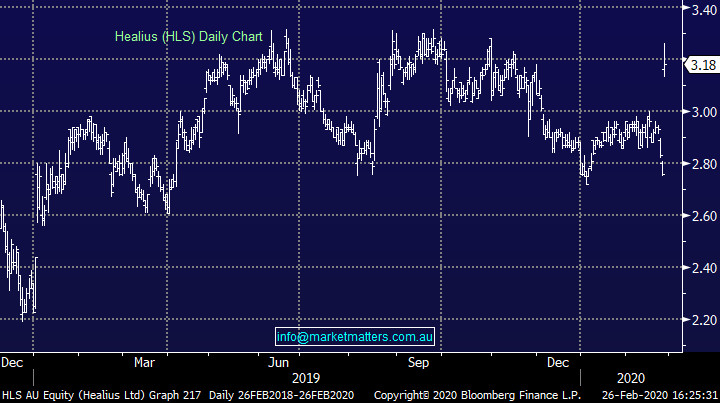

Healius (HLS) +15.22%: a strong move higher against the broader selling on the back of a takeover offer announced last night by Swiss Private equity, Partners Group while Healius also announced their half year results pre-market. The health services business copped a non-binding all cash bid at $3.40 – what was a 23% premium to last close. The board has not yet granted due-diligence, though Partners Group has purchased 15.88% of the shares on issue from the prior Chinese suitor Jangho . Today’s half year result was also positive with profit up around 7.5% on last year with the company revising the lower end of guidance higher. One we held previously.

Healius (HLS) Chart

OUR CALLS

No changes today

Major Movers Today

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. All prices stated are based on the last close price at the time of writing unless otherwise noted. Market Matters does not make any representation of warranty as to the accuracy of the figures or prices and disclaims any liability resulting from any inaccuracy.

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The Market Matters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.