CSL plunges as it abalones Seqirus demerger – is it time to Buy?

CSL plunged lower this morning following the headlines that the company had scrapped plans to complete a demerger of its Seqirus business by June 2026, in other words buyers’ appetite wasn’t where CSL had previously hoped due to volatility in the US influenza market.

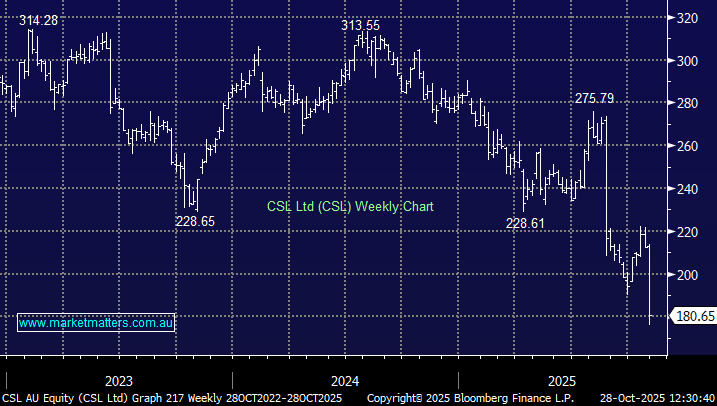

Blood plasma giant CSL, still licking its wounds from an underwhelming full-year earnings and a poorly received restructuring plan, this morning initially tanked almost 20% after slashing its revenue guidance, wiping $17 billion from its market value. CSL’s share price has plummeted more than 40% from its 2024 high while the broad market has pushed ever higher. The ASX healthcare giant was down ~15% at lunch time on fears Australia’s largest drugmaker could witness more downgrades due to weaker growth outlook for the US market:

- CSL said it expects 2026 revenue growth of 2% to 3%, down from a prior forecast of 4% to 5%, and profit growth of 4% to 7% at constant currency, reduced from 7% to 10%.

We intend to let the dust settle around the $180 before deciding whether to cut and run or perhaps average into a panicking market.