Author: Harry Watt

REA Group (REA) +3.1% REA Closed higher today despite what was on most accounts a difficult first half. Trading on a huge 40x earnings, REA saw profit fall 13% to $152.9m in the first half of the year, around 6% below consensus data, on a decline in listings weighing on earnings. The company noted residential […]

Nick Scali (NCK) +10.80%; shot to new 52-week highs today despite falling sales in both LFL and overall metrics as well as falling margins. Nick Scali noted a slip in sales back in October last year, blaming slowing housing sales and renovations for a drop in foot traffic, and subsequently guided the market lower. Today […]

Coles (COL) -0.12%; provided the market with a trading update this morning ahead of their official half year numbers due out in a fortnight. The update was a positive one for Coles’ supermarkets, showing 3.6% same store sales growth for the second quarter with the Christmas trade period exceeding expectations. The strong supermarket numbers were backed up […]

Service Stream (SSM) -9.09%: The essential network services provider reported after market on Wednesday, and on Thursday they were hit hard, down around 9.09%. The result was a decent one, inline with prior guidance however it seemed the market had gotten slightly ahead of itself. Macquarie put out a bullish note a few days ago […]

**This is an extract from the Market Matters Morning Report from 3 February. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more Question 3 “Hi Team, Thanks for a great and profitable service over the last year or […]

The two listed real estate trusts managed by the Centuria Group (ASX:CNI) reported their first half numbers this morning, coming in largely inline with expectations. Centuria Industrial REIT (CIP) +0.82% half yearly results reaffirming FY20 guidance of FFO/share of between 19.6cps and 19.9cps with a dividend of 18.7cps. NTA increased 3.7% to $2.83/share. Occupancy was […]

**This is an extract from the Market Matters Morning Report from 31 January. Click here to get access to the full report and more The underlying gold price in Aussie Dollar terms is surging to fresh all-time highs enjoying a positive 2-edged sword: 1 – The gold price in its usually quoted $US/oz is making […]

Nearmap (NEA) –29.84%: for the second day in a row the ASX saw 2 stocks hit for more than a quarter of their value with Nearmap taking a beating from investors today. The mapping tech company gave an FY20 update this morning that showed annualized contract value (ACV) rise 23% over the calendar year as […]

Fortescue Metals (FMG) –2.08%: Great set of production numbers from FMG today with an upgrade to FY guidance to boot, albeit a small one (+1.5%). Lots of interest in FMG so worth delving into the detail on this with Peter O’Connor’s (Shaw) comments as follows….A good set of numbers which were in line with ship […]

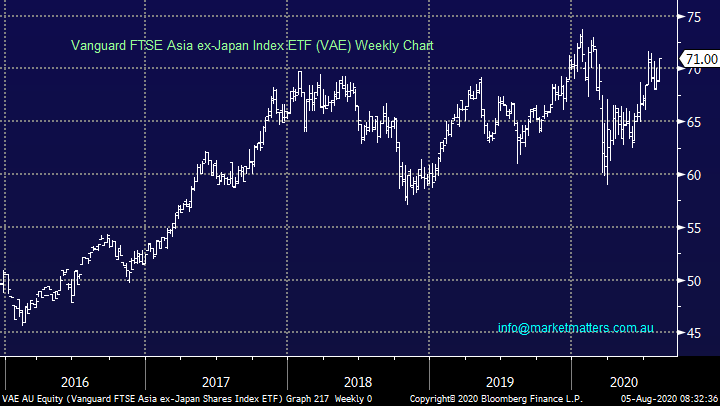

**This is an extract from the Market Matters Morning Report from 28 January. Subscribers have the opportunity to ask questions of the Market Matters team throughout the week. Click here to get access to the full report and more Question 2 Can you suggest a suitable: *Ethical Global ETF *Ethical Australian ETF for me to […]