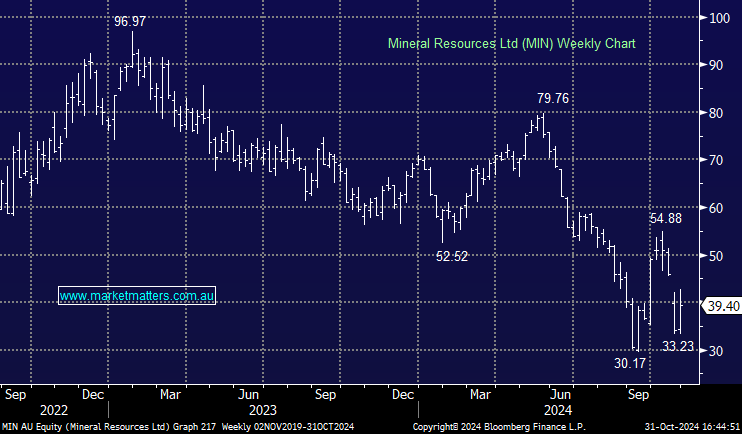

A much needed cash injection for Mineral Resources (MIN)

MIN +9.2% exploded out of the gates this morning, up as much as 18% before simmering on the close. The lithium and iron ore miner released quarterly production numbers that were okay, but more importantly, a $1.1bn transaction with Gina Rinehart led Hancock Mining. MinRes is selling its exploration tenements in the Perth basin to Hancock, as well as entering a joint venture on its remaining owned gas exploration projects that weren’t part of the deal.

The deal consists of:

- Upfront consideration of $804m to MinRes by the end of 2024

- Additional payments of up to $327m expected to be paid prior to end FY25, subject to certain conditions

- 50% JV on Perth and Carnarvon Basin permits, remaining as operator, with Hancock to fund capex requirements

Prior to recent noise relating to the group CEO, much of the criticism toward MinRes has been driven by its leverage and lack of balance sheet flexibility in the face of lower commodity prices. The cash gives the business much needed cushion for continued operations while awaiting price recovery, especially in the lithium space.

Whilst this deal has created a convenient distraction, the company isn’t out of the woods just yet – corporate governance issues relating to CEO Chris Ellison are still loitering. Regardless, we see this deal as highly beneficial long-term, and the governance issues as short-term noise. We hold the stock in the Active Growth Portfolio.