What drives the Gold price?

Dear James,

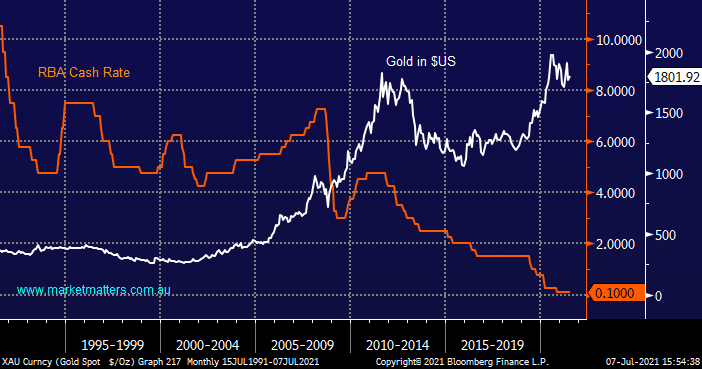

I have learned so much more about the workings of the stock market since I became a member of MM. Thank you. Gold : I have copied and pasted a quote from a Morningstar article written by Holly Black, February 20. “ When inflation equals or exceeds interest rates, golds investment attractiveness increases. This is because gold is seen as safe, physical store of value, protecting investors’ money in times of uncertainty. Conversely, when investors are more risk-on and interest rates are high, gold effectively losses money because it cannot pay an income or grow”. So this means when interest rates exceed inflation, the gold price can be expected to come down. What’s your view on the future of interest rates and inflation, and the gold price? Should we be looking at U.S. statistics only?

Thanks

Raj