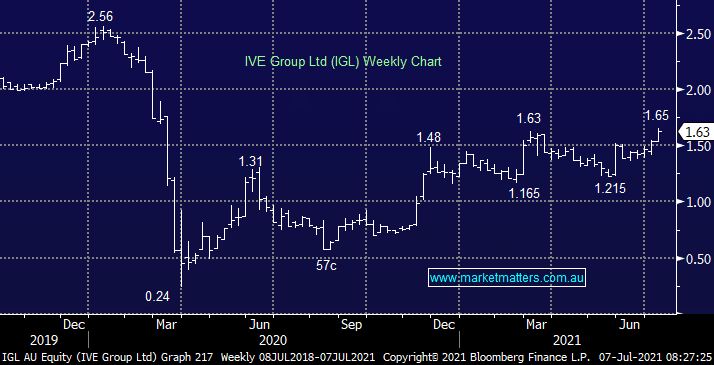

The integrated marketing and printing business has been a weak link in the Income Portfolio (as well as the Emerging Companies Portfolio), hurt particularly hard through Covid, however the stock more recently has been a quiet achiever rallying nearly 7 fold since March 2020. Importantly, the company did not have to raise equity capital at depressed levels and the share price is reaping the benefits now. The company trades on just 7x expected earnings, a likely yield in excess of 6% & has a share buy-back in place.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Close

Close

Thursday 11th September – Dow off -220pts, SPI off -20pts

Thursday 11th September – Dow off -220pts, SPI off -20pts

Close

Close

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Close

Close

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Close

Close

Monthly Update: Portfolio performance and positioning during October

Monthly Update: Portfolio performance and positioning during October

Close

Close

MM remains bullish IGL

Add To Hit List

Related Q&A

IVE Group Ltd (IGL)

How To Respond To IGL’s New Capital Management Policy?

Possible interesting moves in the IVE Group (IGL) share registry??

IVE Group Limited (IGL)

How much of a challenge is AI to IVE Group?

Two IGL directors selling large parcels of shares – any cause for concern?

Why is IVE Group (IGL) getting smashed?

Is the sell-off in IVE Group (IGL) overdone?

IVE Group (IGL) – is it time to sell?

What are MM’s thoughts on the surge in IGL’s share price?

What are thoughts on Calix, IGL, SIQ and SUL?

Thoughts on IGL Share Purchase Plan & the new norm for markets

IVE Group (IGL)

Relevant suggested news and content from the site

Video

WATCH

Market Matters Monthly Video Update: Portfolio Performance for November 2025

Recorded Wednesday 10th December

Podcast

LISTEN

Thursday 11th September – Dow off -220pts, SPI off -20pts

Daily Podcast Direct from the Desk

Video

WATCH

Webinar Recording | Will NVIDIA Ignite or End the AI Trade?

Recorded Thursday 20th November

Podcast

LISTEN

Wednesday 10th September – Dow up +196pts, SPI down -4pts

Daily Podcast Direct from the Desk

Video

WATCH

Monthly Update: Portfolio performance and positioning during October

Recorded Thursday 6th November

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.