Hi Michael,

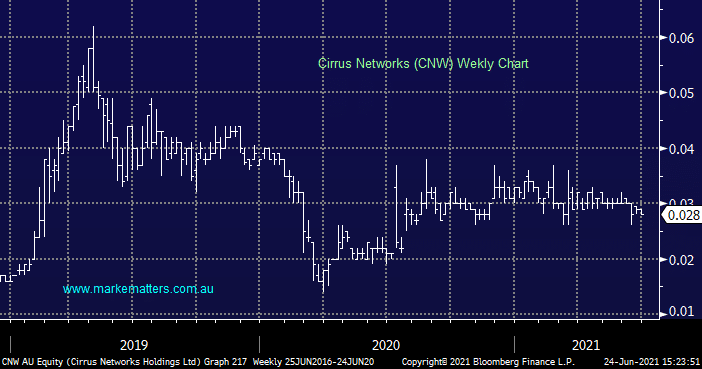

I’m not familiar with this $25m West Australian IT Infrastructure business but as we often say the share price usually tells the tale, in this case CNW has indeed gone nowhere for the last 2-years and we can do no more than put it into the too hard basket. Having a quick look at the financials shows solid growth in revenue i.e sales, but very low margins and only a tiny amount of free cash flow, plus of course, lots of options on issue never help.

From a risk / reward basis we could buy this “speccy” if it rallies to 4c then running stops below 3.4c which would amount to a 15% risk but its not one for us.