Yesterday morning we saw Brisbane go into a snap 3-day lock down as fears the UK strain of COVID was about to explode through the capital of the Sunshine State, undoubtedly plenty of Easter holidays have been thrown into disarray by this one press conference. Unfortunately as we’ve repeatedly said at MM while we allow people to come back into Australia via quarantine outbreaks are inevitable, let’s hope that as the vaccine rolls out slower than many expected we don’t ruin our great track record against the virus – at this stage Australia is still the envy of the developed world.

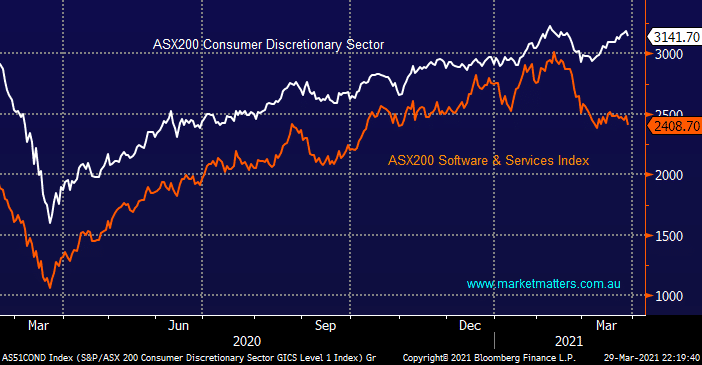

Interestingly of the 2 negative influences which hit the ASX yesterday we actually saw Tech suffer far more than travel & tourism stocks (Consumer Services). Basically the recent trend of underperformance by the tech stocks has continued through the month as we can see below, at this stage investors obviously believe the current Brisbane lockdown will work and the virus will be contained in a similar matter to that on Sydney’s Northern Beaches.

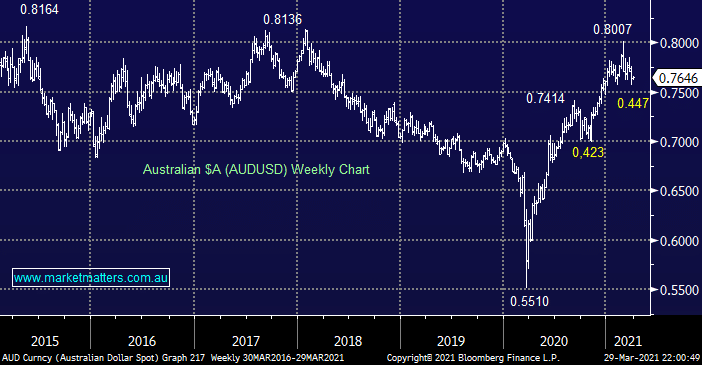

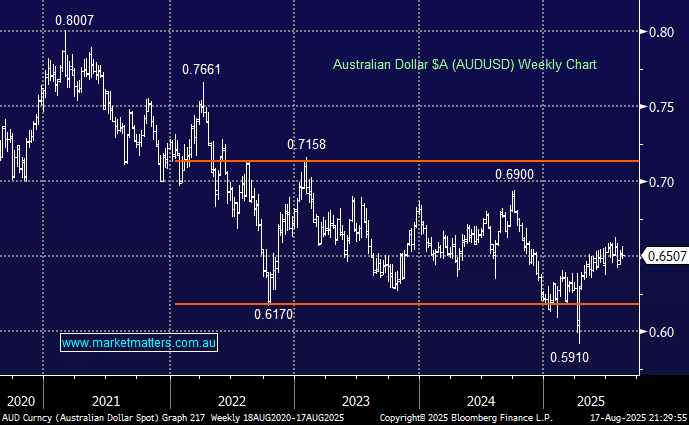

The local currency literally ignored the QLD decision yesterday confirming investors belief that the current lock down would be short and effective, at this stage we have no reason to believe they are wrong.