Opinion on CBA & ANZ, BVS, CGF, EOS, RMS & RSG

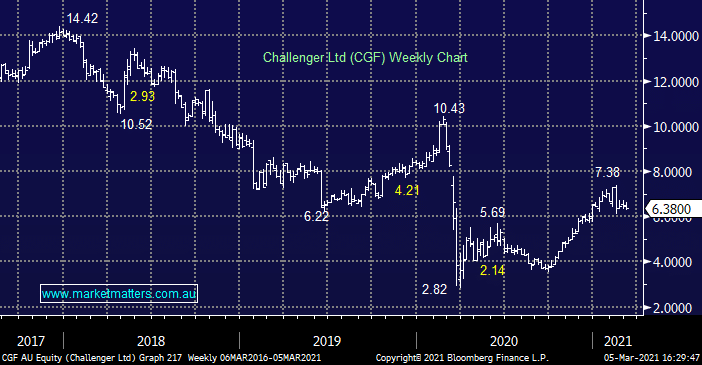

Hi. I'd like your opinion on CBA & ANZ. I am holding a good position in each and want your opinion on continuing to hold or sell some or whatever. Also I am holding positions in BVS, CGF, EOS, RMS & RSG all of which are pre my time with MM. Can you please give me your opinion on these, as I am considering buying a little more of a couple of them, in order to recover a little from the lows. I really like the way you guys operate. Thanks again, MickO'