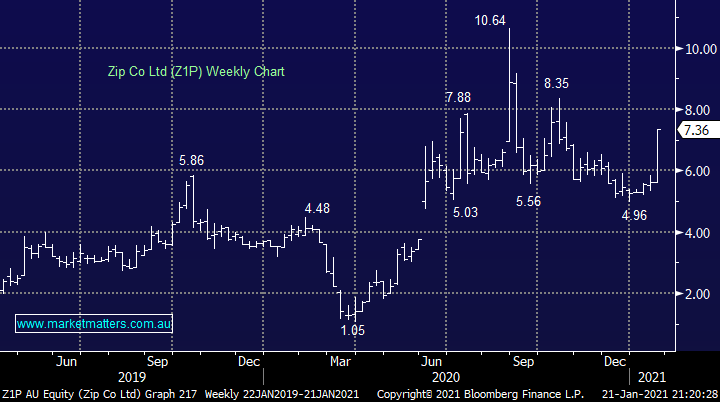

Yesterday Zip Co (Z1P) delivered a very impressive report for the December quarter and the market certainly responded with the stock soaring 23% in just one session however we believe Z1P still appears very cheap when compared to its peers in the BNPL space like Afterpay (APT) and Affirm (AFRM US). Customers for Z1P almost doubled YoY to 5.7m while importantly merchants increased to 38,500, these impressive stats rolled through to an 88% increase in revenue.

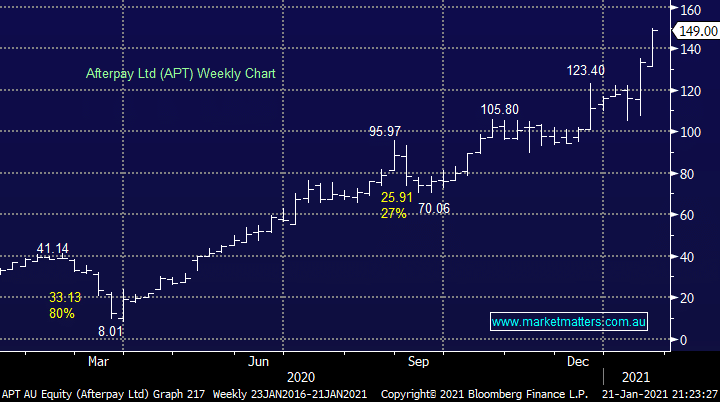

Afterpay (APT) is now valued at $42.5bn compared to Zip (Z1P) at $4bn but APT only transacts ~2.5x more than Z1P. I like Z1P’s attitude to chase quality growth as opposed to any growth, a goal which translated to bad debts as a factor of turnover falling 20% from the previous quarter.