The ASX regains its mojo (SHL, ALU)

WHAT MATTERED TODAY

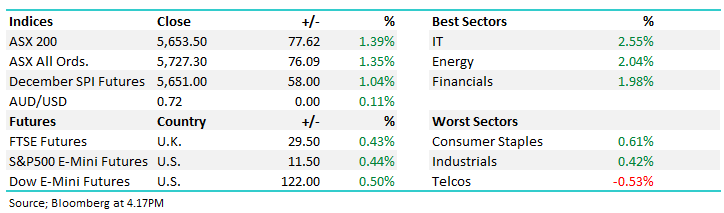

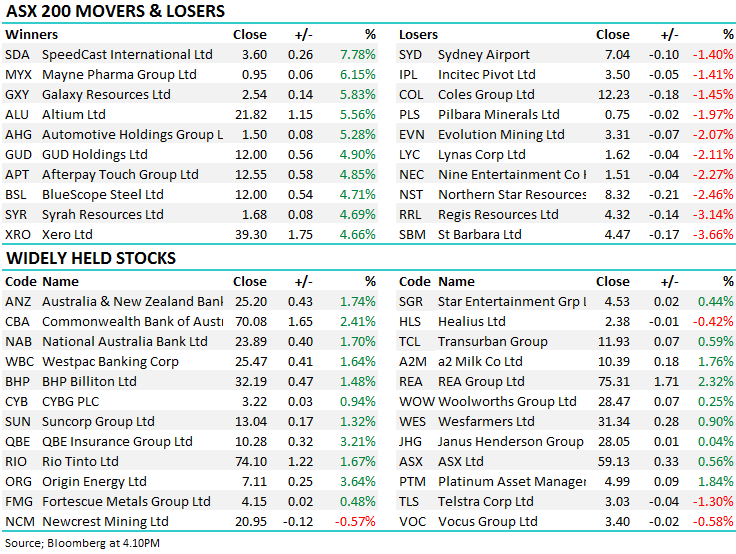

Despite a soft US lead, the local index opened higher and didn’t really look back today, particularly in the last few hours of trade where the bulk of the rally happened. There was no real news to drive the market higher, at least nothing that hit the boards in the afternoon when sellers seemed to disappear. Banks were all strong, with each of the Big 4 adding more than 1.5% - Commonwealth bank (ASX: CBA) was the standout with +2.41% on the day. Most notably though was the move up the risk curve with the growth leveraged sectors of tech & energy doing the best, whereas the safety of telcos, industrials & the consumer staples underperforming on the day.

A number of the dogs rallied strongly today as well. Some of note: Challenger (ASX: CGF) added 4.63% after bouncing off multi year lows early in the day, Bluescope (ASX: BSL) added 4.71% & Automotive Holdings (ASX: AHG) climbed 5.28% after setting a new 5 year low yesterday. Despite the solid rally, it’s hard to get too excited just yet as we are still short of where the index was trading on Friday.

One factor that did help the gains today was a report out from NAB that suggested the bulk of the house price falls were behind us, revising their expectations to a 15% slump. Despite this upgrade, the NAB economists are still concerned with consumption as many households feel the wealth pinch due to the falling prices, extending the time they expect the RBA to remain on hold out to the back end of 2020 while seeing unemployment falling and growth slowing to 2.5%.

Overall, the ASX 200 closed up +77 points or +1.39% to 5653. Dow Futures are currently trading up 122 points or +0.50%.

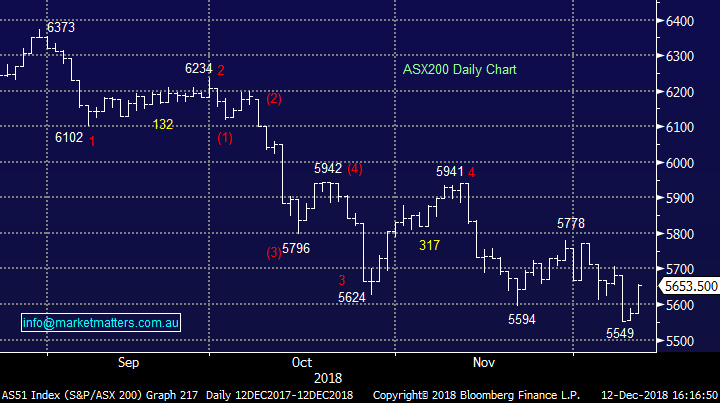

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE;

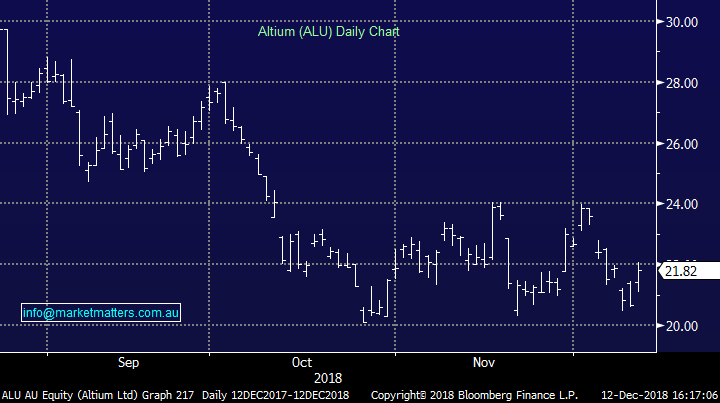

Broker Moves; This morning Goldman Sachs initiated coverage on Altium (ASX: ALU), a stock we hold in the Growth Portfolio, with a buy and fairly aggressive price target of $28.50, versus yesterdays close of $20.60. A move like that is obviously positive but more importantly, the new coverage from a bulge bracket brings a new cross section of clients that now have ALU on their radar. Goldman’s provide research for Com Bank which has the largest retail network in Australia through Commsec. I’m not sure of the timing that research is released through the network (probably a delay) however we’d expect it to generate additional interest / buying in the stock. We remain bullish ALU targeting the $24 region in the short term. The stock added 5.56% today to close at $21.82.

Altium (ASX: ALU) Chart

ELSEWHERE:

· Bendigo & Adelaide Cut to Sell at Deutsche Bank; PT A$9.50

· Livetiles Downgraded to Sell at Wilsons; PT A$0.29

· QBE Insurance Upgraded to Buy at Morningstar

· QBE Insurance Upgraded to Add at Morgans Financial; PT A$11.61

· Premier Investments Upgraded to Hold at Morningstar

· Altium Rated New Buy at Goldman

Sonic Healthcare (ASX: SHL) $21.39 / unch ; largest ASX-listed diagnostic imaging facilities group is about to get bigger after it went into a trading halt to announce a US$540 million ($750 million) acquisition and a large capital raising this morning. Sonic Healthcare struck a deal to acquire US-based Aurora Diagnostics, which will make it the third largest player in the US market with Aurora generating $US 310m revenue and $59m EBITDA in 2018. Sonic will be looking to raise around $US 700m from investors to fund the deal at around a 9% discount to last close, with the deal looking to add 3% to EPS in the first year. One to watch here as Sonic looks to grow despite its share price fall.

Sonic Healthcare (ASX: SHL) Chart

OUR CALLS

No changes today.

Have a great night

James, Harry & the Market Matters Team

Disclosure

Market Matters may hold stocks mentioned in this report. Subscribers can view a full list of holdings on the website by clicking here. Positions are updated each Friday, or after the session when positions are traded.

Disclaimer

All figures contained from sources believed to be accurate. Market Matters does not make any representation of warranty as to the accuracy of the figures and disclaims any liability resulting from any inaccuracy. Prices as at 12/12/2018

Reports and other documents published on this website and email (‘Reports’) are authored by Market Matters and the reports represent the views of Market Matters. The MarketMatters Report is based on technical analysis of companies, commodities and the market in general. Technical analysis focuses on interpreting charts and other data to determine what the market sentiment about a particular financial product is, or will be. Unlike fundamental analysis, it does not involve a detailed review of the company’s financial position.

The Reports contain general, as opposed to personal, advice. That means they are prepared for multiple distributions without consideration of your investment objectives, financial situation and needs (‘Personal Circumstances’). Accordingly, any advice given is not a recommendation that a particular course of action is suitable for you and the advice is therefore not to be acted on as investment advice. You must assess whether or not any advice is appropriate for your Personal Circumstances before making any investment decisions. You can either make this assessment yourself, or if you require a personal recommendation, you can seek the assistance of a financial advisor. Market Matters or its author(s) accepts no responsibility for any losses or damages resulting from decisions made from or because of information within this publication. Investing and trading in financial products are always risky, so you should do your own research before buying or selling a financial product.

The Reports are published by Market Matters in good faith based on the facts known to it at the time of their preparation and do not purport to contain all relevant information with respect to the financial products to which they relate. Although the Reports are based on information obtained from sources believed to be reliable, Market Matters does not make any representation or warranty that they are accurate, complete or up to date and Market Matters accepts no obligation to correct or update the information or opinions in the Reports. Market Matters may publish content sourced from external content providers.

If you rely on a Report, you do so at your own risk. Past performance is not an indication of future performance. Any projections are estimates only and may not be realised in the future. Except to the extent that liability under any law cannot be excluded, Market Matters disclaims liability for all loss or damage arising as a result of any opinion, advice, recommendation, representation or information expressly or impliedly published in or in relation to this report notwithstanding any error or omission including negligence.