Hi Debbie,

A very topical question that by definition has a few moving parts for many subscribers around capital gains, dividends, franking credits etc. In this answer we have taken none of these factors into account having simply considered the current share price and fundamental backdrop.

With the exception of CBA the banks have posted new all-time highs this month after delivering strong earnings and even CBA has rallied +20% over the last fortnight. Hence, the banks are delivering operationally with as you say dividends due in February for CBA and May for the other three. The banks are clear beneficiaries of the current aggressive rotation from growth to value which if history is any indicator will run further than any of us expect.

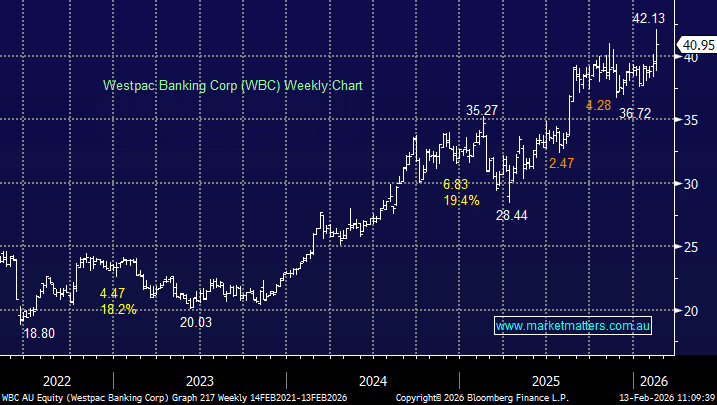

However, the banks have now reached our target areas identified in MM reports over recent months.

- If we were overweight the sector, we would be trimming positions, particularly WBC and NAB.

- We covered WBC specifically on Friday afternoon, moving to a more neutral stance above $40.

- The turn around at ANZ still has a long way to run, and we think they’ll continue to be the outperformer in the sector.