Hi Darren,

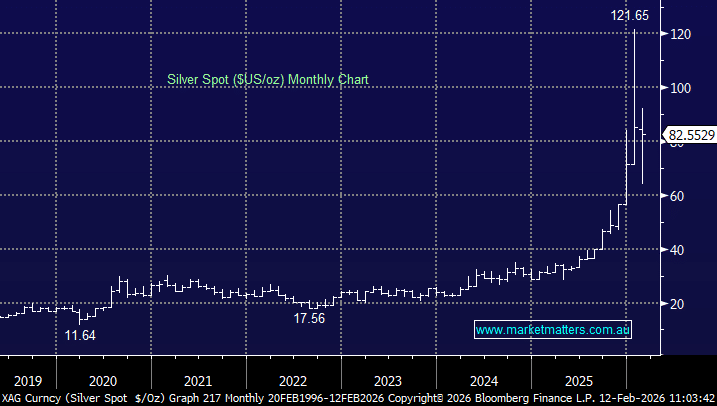

Silver is more than just a solar story, and unlike gold, it straddles precious-metal appeal and industrial necessity. That dual demand profile increases sensitivity to both macro factors (inflation, FX) and industrial cycles (tech buildouts, EV adoption, energy policy). Multiple industry surveys indicate the global silver market has already run supply deficits for several consecutive years, leading to the price exploding north as punters chased precious metals higher on the debasement trade.

- We must remain conscious that commodities are cyclical and if prices run too hard mines ramp up production and as you said end users look for alternatives.

The current total global silver demand is ~1.1–1.2 billion ounces per year of which 55-60% is for industrial use, an estimate of the current breakdown is:

- 36% electrical & electronics, 28% solar, 24% brazing, alloys, chemicals, and 12% automotive including EV’s.

Moving forward a decade, industrial demand is forecast to lift ~30% with solar the fastest-growing segment (installations still expanding globally). Silver is structurally shifting from a “precious metal with industrial uses” to an industrial metal with monetary characteristics. However, you have mentioned one of the key downside risks for silver:

- Aggressive silver-thrifting in solar/substitution (copper, aluminum in some uses) – inevitable to a degree with silver at current levels.

Indeed, copper can replace some silver in solar panels, and it probably will replace more over time being 100x cheaper. But silver’s conductivity, durability and established manufacturing ecosystem make a full displacement unlikely in the near term. The trend is already unfolding but copper oxidises easily which reduces conductivity and durability while silver is much more stable. Also, solar manufacturing runs on razor-thin margins – changing process = capital cost + yield risk.

We haven’t changed our bullish stance, but we wouldn’t advocate chasing silver up towards $US100/oz from a risk/reward perspective believing there’s a very good chance of being able to accumulate through 2026/7 in the $US60-80 area.