Hi Mark,

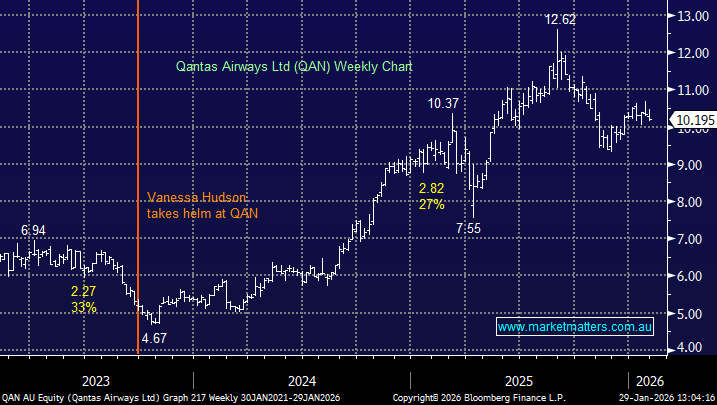

The timing of Vanessa Hudson becoming the CEO of Qantas in September 2023 does indeed appear to have been the catalyst for the QAN share price to spring higher as she helped repair investor confidence and reduced the “headline / reputational discount”. The advance was also helped by a firm stock market, domestic and international travel remaining robust, and the market beginning to believe profits were more sustainable than a one-off post-COVID spike, leading to upgrades and a re-rating. We’re sure Alan Joyce would not agree, preferring the view that it was his harsh/structural decisions to reduce the cost base that is now bearing fruit!

While demand remains strong and fuel prices are supportive, Qantas is entering a heavy investment cycle as it renews its fleet with new A321XLRs and Project Sunrise A350s, a major capital commitment over the next decade. At the same time, rising costs (including Same Job Same Pay impacts, SAF investment requirements and higher operating expenses) are likely to cap margin upside, although for now ongoing capital returns, particularly dividends, are keeping investors supportive.

- Moving forward the stock trading close to fair value, hence we are neutral around $10, and not buyers of the flying Kangaroo.