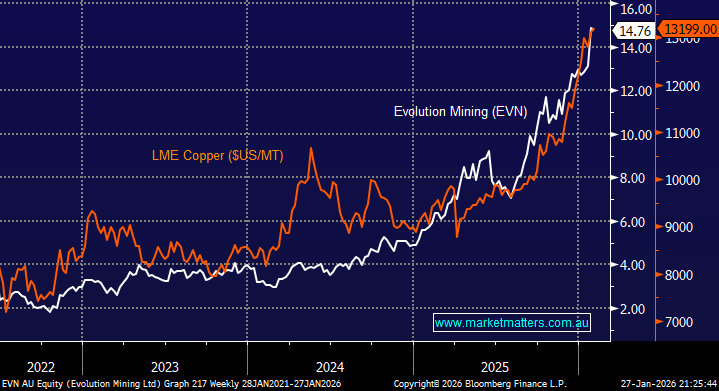

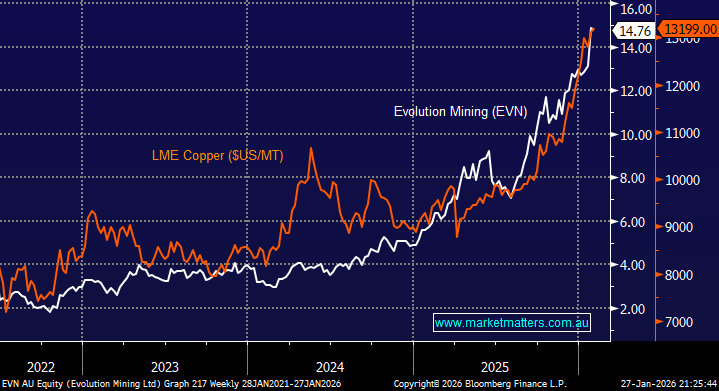

The stampede by investors into copper stocks is comparable to that of gold in places. The panic buying in recent times is by the Global X ETF (WIRE), which tracks copper miners, has attracted more inflows since January than the whole of 2025, marking its strongest start to the year on record. The surge has outpaced flows into both gold and silver ETFs, highlighting investors’ growing conviction in the copper theme. The ETF has doubled since mid-2025, eclipsing the gains in the underlying industrial metal.

Even as copper steadied overnight, US ETFs with exposure to the industrial metal advanced. Another $2-3 pullback in the WIRE ETF wouldn’t surprise us, but we advocate buying dips until further notice – the users that are being pedantic today are likely to become far more proactive into any weakness.

- We can see a pullback in the short term, but remain bullish through 2026/7.