Hi Josh,

Great question, and you’re not missing the core logic. If you genuinely believe equities rise over time, as history suggests, gearing should increase long-term returns. The catch is that the path matters, and geared ETFs introduce a few structural issues that mean they often don’t deliver the simple “market return × gearing” outcome investors expect:

- Costs geared G200 0.35% pa v ungeared at 0.04%, a significant difference which compounds over time.

- Volatility drag is a real issue because a geared ETF magnifies both gains and losses, e.g. If the A200 falls 20% you need +25% to get back to even but a 2:1 geared one needs to advance 67% to erode the losses.

- Borrowing cost are not trivial or fixed, hence the market needs to rise by enough to cover fees + interest + volatility drag.

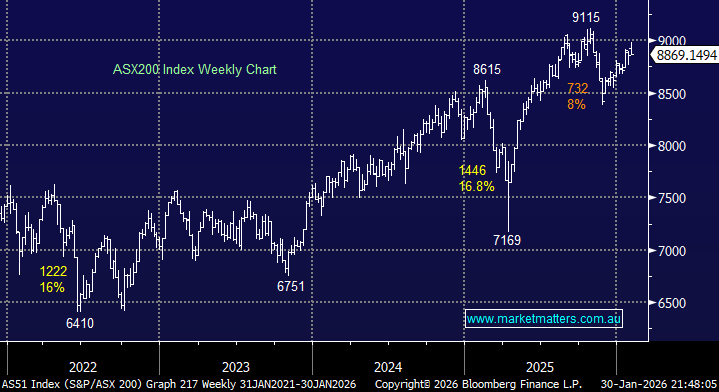

A holder of a geared product is essentially swapping higher expected returns for bigger drawdowns, higher costs and greater behavioral risk. If an investor can genuinely hold through severe market falls and accept the extra volatility without panicking, a geared ETF like G200 can make sense – but it is dependent on time frame and risk tolerance. However, for most true “set and forget” investors, A200 is the better fit because it’s far more survivable through inevitable market downturns. The below examples show how you have needed to hold your nerve in the G200:

- COVID: G200 down 70% needed +233% to recover.

- In 2022, when markets were choppy and trending down, gearing tends to hurt because you get magnified losses plus volatility drag, while borrowing costs also rose.

In real life markets (which include crashes and chop), the geared product can suffer deep drawdowns and long recovery periods, which is why it’s rarely a true “set and forget” holding. The other aspect is how they structure the gearing in an ETF. They use a daily target, so if the ETF drops, it pushes the embedded gearing up, so the ETF provider will reduce exposure to maintain target gearing. That means they are effectively selling into weakness, but also buying into strength when the gearing target falls in a rising market.

An investor will have better control using other gearing strategies relative to a geared ETF.