Hi Charles,

This alternative asset manager offers a range of investment strategies including long/short equities, private credit, real assets and event-driven funds. It earns revenue mainly from management and performance fees, so its earnings are leveraged to fund performance, market levels and FUM growth. They have changed their model in recent years, expanding from such a heavily reliance on Phil King’s stock picking into a more diverse model, owning other manager outright, or large equity stakes within them, across various asset classes.

We’ve held RPL for a few years and its reasonable yield has looked after us during times of uncertainty – its projected to be ~~3.8% fully franked over the coming years.

- The historical or actual PE is 28x as shown on the Market Matters website, which is based on FY24 numbers (RPL is a Dec year end). But earnings are going to kick up in FY25 given a big uplift in performance fees. On FY25 Estimates (with earnings set to be released on the 24th Feb), the PE drops materially to ~10x, however, as mentioned, a lot of the uplift is performance fee related, so may not be replicated in outer years.

The volatility in RPL is driven by the underlying “bets” placed by Phil King & Co. Traditionally, RPL has been an equities manager, but they’ve recently pushed into Private Credit via the acquisition of Merricks Capital in June 2024, picking up ~$3bn of credit FUM. We liked the deal, given it moves Regal closer to being a diversified multi-brand, multi-strategy investment manager across different asset classes with scale.

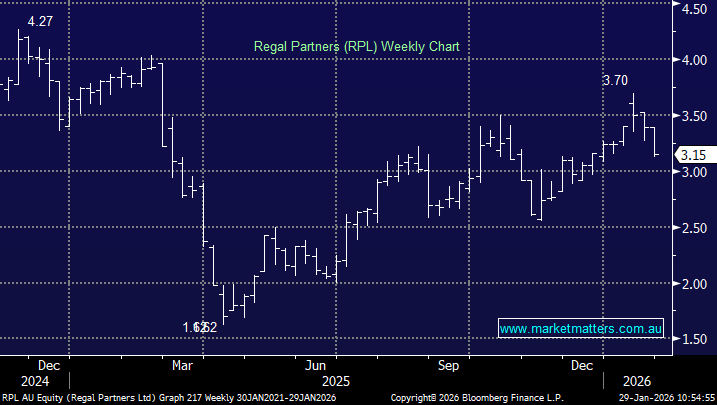

The company has relatively “big bets” which creates some underlying volatility in the short term given their aggressive performance related fee structure. Ultimately, it’s a business we like and remain long with no plans to sell. However, from a valuation/technical perspective, if we were trading the stock we would be buyers around $2.50 and sellers closer to $4, so we’re more neutral around $3.20, and do not view it as a ‘screaming buy’ right here and now.