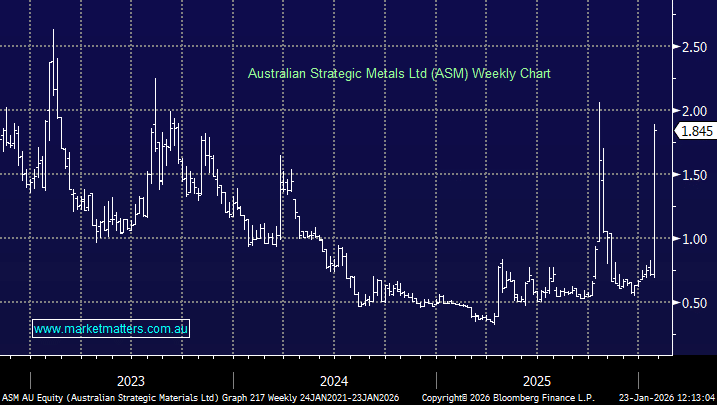

Australian Strategic Metals Ltd (ASM)

Hi James & Team ASM has increase by 130% + this week. Can I have your view on Energy Fuels offer to acquire Australian Strategic Materials. " Under the Scheme, eligible ASM shareholders will be entitled to receive: 0.053 Energy Fuels shares or CHESS Depositary Interests for each ASM share held (representing implied value of A$1.47 per ASM Share) and A$0.13 in cash per ASM Share, payable as an unfranked special dividend by ASM. The transaction structure implies an ASM equity value of ~A$1.60 per ASM Share." Would you hold on to ASM and accept the offer of Energy Fuels CHESS Depositary's? or sell your ASM shares into the current strength? ASM shares are trading $1.85 today. regards Debbie