Hi Scott,

Regal Investment Fund (RF1) is a $760mn Australian listed investment trust designed to give investors access to a diversified mix of alternative investment strategies managed by Regal Funds Management. It’s built for people who want returns that don’t simply rise and fall with the broader share market, and it has become a notable player in Australia’s alternative asset space.

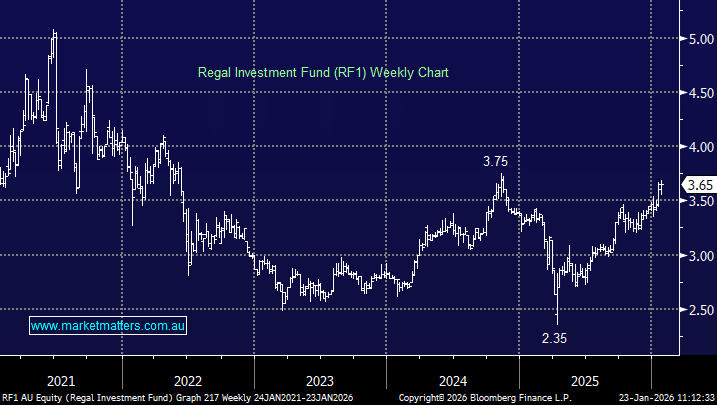

RF1 was trading ~5% above its NAV on Friday. We like the diversification offered by RF1 around $3.60 helped by its attractive yield, around ~5%. It’s a solid option in the Alternatives space.

We’ve looked at the two major US stocks primarily from a technical perspective:

Visa (V US) – we are neutral towards Visa ~$US325 where it traded though much of 2025.

Netflix (NFLX US) – the streaming company is interesting around $US80 after correcting ~37%, but with subscriber growth slowing and production/content costs on the up, it’s not a stock we would chase – we are cautiously bullish below $US85.