Hi Sidney,

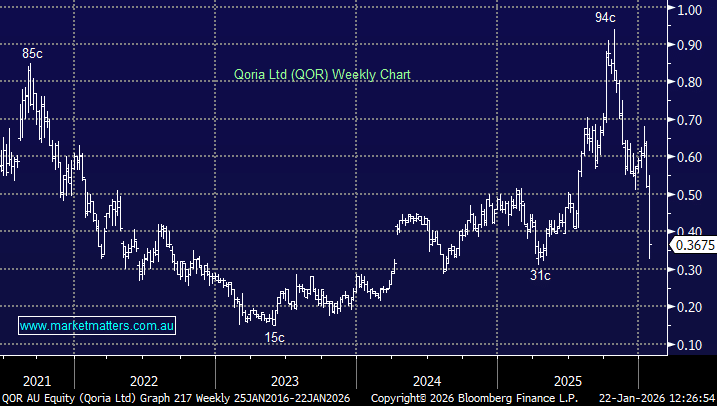

Digital safety company QOR has fallen over 30% this week since announcing a disappointing second quarter update which led to a number of large analyst downgrades averaging around 20%.

- Annual ARR grew to $149.6mn up +13% YoY for the quarter.

- They reported cash receipts of $79.1mn up +20% YoY.

- They maintained FY26 revenue guidance of over $145mn and ARR growth of more than 20%.

- But the company still recorded negative free cash flow.

In simple terms, QOR fell because its high valuation and strong rally into late CY25 left little room for error, and the update failed to deliver a sufficiently bullish outlook or profit surprise to justify the elevated multiples. To us the risk reward is evenly balanced around 36c.

QOR does have some well-respected fund managers on its register, but always be conscious that when most fundies are talking up a particular stock, it’s because they’ve probably owned it from lower levels, and they’re trying to highlight how smart they are, so people will invest in their fund!