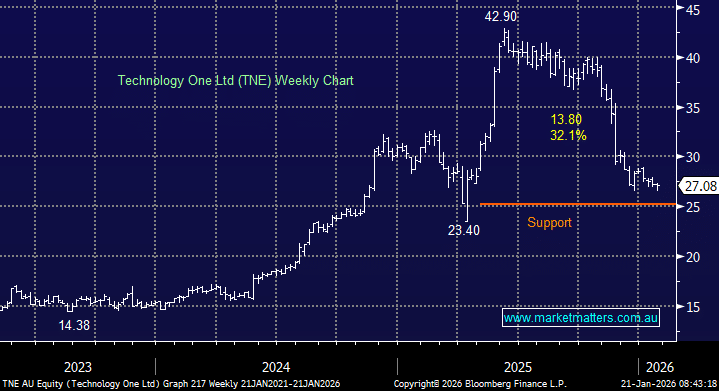

Technology One (TNE) is an enterprise software company that has corrected 32% from its June high, with most of the damage occurring in November after it reported annual recurring revenue (ARR) below expectations and provided no FY26 guidance. They provide mission-critical ERP, finance, and HR systems to governments, universities, and large organisations, delivered primarily via cloud-based SaaS. We looked at November’s result in detail here at the time, adopting a neutral stance around $30. However, the stock is now 10% lower, trading on a less demanding 55x for a company that’s expected to grow revenue by +32% from FY25 to FY27.

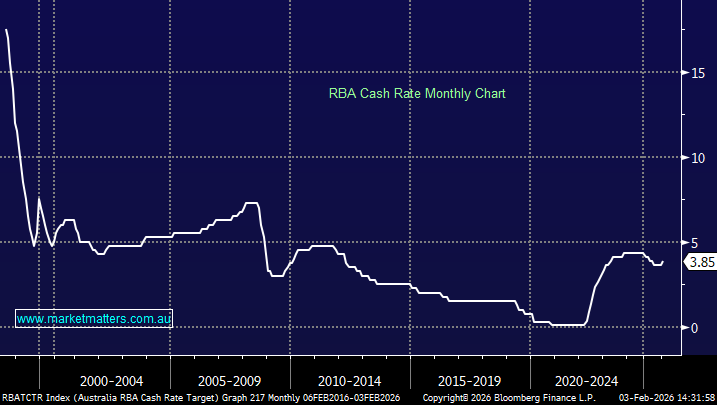

The business still looks to be on track to achieve management’s target of ~$1 billion in ARR by FY30, aided by its global expansion with over 8% of revenue from the UK in FY25. In the UK: ARR was up +49% YoY with New Sales ARR +51%, reflecting recent customer wins, including a strong pipeline of deals into FY26. Importantly, for a high-growth stock it’s got real earnings from a stable government-skewed customer base. The big question around TNE hasn’t been so much around its quality and growth, but what price should we pay for this growth? Market sentiment is a large determining factor on the valuation applied to growth stocks, and at the moment, they are firmly in the naughty corner.

- We believe the valuation re-rating experienced by TNE is maturing as the stock approaches major support in the $25-27 area.