Precious Metals

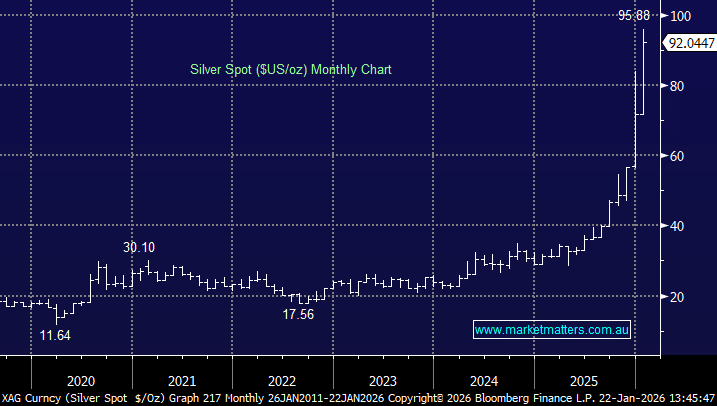

I have a real interest in ETPMAG (Silver); ETPMPD (Palladium); ETPMPM (Precious metals basket) and ETPMPT (Platinum) as 3 month or so investments, especially if IKO (Korea as a 50% weighting in my portfolio) falls over. I have read a long article by Sprott Asset Management - who you may have come across, as like you they are very sophisticated analysts, and the future of silver looks very positive. What do you think? I'm keen to be able to sleep at night, particularly as their rise has been so rapid, I get apprehensive about a bigger pull back than you mention in your notes on ETPMAG. Looking for some guidance here as I'm well aware I'm a late entrant into this groups of precious metals. I'm interested in your outlook for these metals, especially as for a very short time - about 3 weeks - I was kicking myself for not having a position in precious metals. Not today though (30 Dec) as at 11.10 am silver down 8.6%, palladium down 9.8% and platinum down a mere 13.1%. With the rapid rise, one could only expect a rapid decline, but as I prefer not to be on the computer 24/7 I invested heavily in Asia instead. So what next in 2026 in your opinions?