Hi Paul,

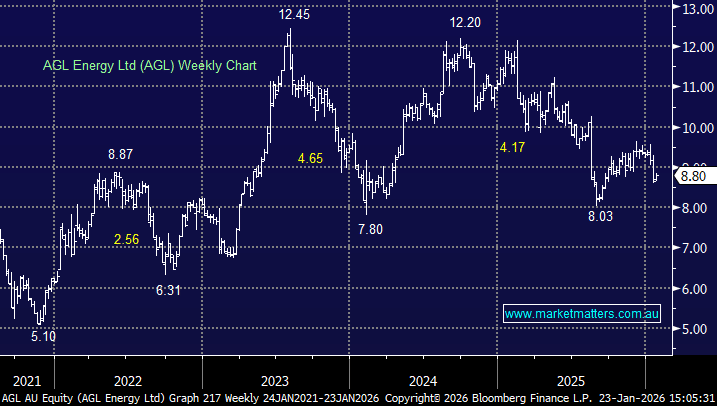

AGL has fallen ~5% from its December high, nothing too bad considering the markets treading water and fears of RBA hikes through 2026. However, a softer outlook for Australian power prices in NSW, which have been weakening over the last 3-months, could become a headwind to earnings moving forward. Importantly, AGL is banking on renewables to revive its fortunes, but its FY26 forecast was weak last August, and the stock has struggled since.

- AGL’s $3bn battery investment is pivotal to offsetting lost earnings from legacy gas and coal contracts.

We like AGL below $9 believing its more than 5% ff yield offsets the risks coming into next month’s update with investors already nervous – the stocks trading 16% below its average 5-year EBITDA multiple – we own AGL in our Active Income Portfolio from lower levels.

Lindsay (LAU) is a ~$250m integrated transport, logistics, and rural supply company with an emphasis on food, including processing, services, fresh produce, agriculture and horticulture industries. LAU has traded sideways since dropping more than 25% last February after the company delivered a results downgrade in everything but name. While revenue held up, margins were squeezed by higher costs and softer freight conditions, driving earnings lower and forcing the market to reset expectations. For a stock priced for steady execution, any earnings slippage was enough to trigger a sharp de-rating.

- LAU is forecast to yield 5.7% ff this year but next month’s earnings update comes with plenty of risk.

Overall, we believe the risks on both stocks are about the same, but we’d probably lean on the side of waiting until they report before pulling the trigger.