Hi Andrew,

Silex Systems is an Australian developer of advanced laser isotope separation (SILEX) that aims to transform uranium enrichment for nuclear fuel and other high-value isotope applications like quantum silicon and medical isotopes.

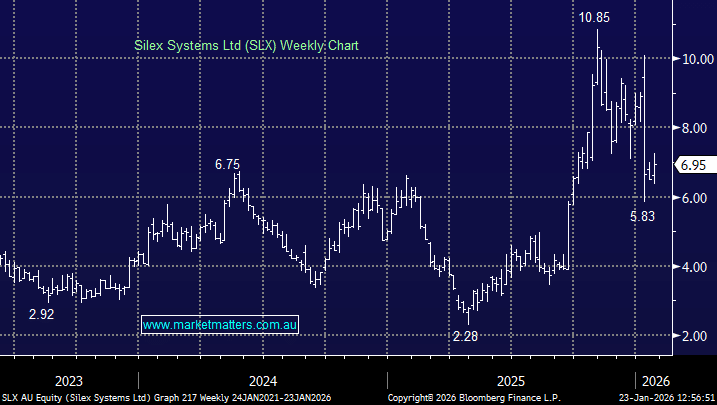

This week SLX’s exclusive licensee for its SILEX laser uranium enrichment tech, Global Laser Enrichment (GLE), was not selected for the full $US900 million U.S. Department of Energy (DOE) award under the Low-Enriched Uranium (LEU) program, which was expected to support new domestic enrichment capacity. GLE did receive ~US28 million to continue advancing the technology, but the much larger funding was won by other entrants. The news led to a significant short-term derating of the stock.

- Without the funds GLE, and by extension SLX, will need to find alternative financing (equity, partners, debt, or smaller awards) to fund commercial scale-up.

SLX’s commercialisation pathway was not dependent on winning the US$900m DOE grant, but that funding would have been a major accelerant. Missing out doesn’t break the technology story, but it slows the timeline and raises funding risk for a full commercial enrichment plant. Going forward, funding is likely to come from a mix of Cameco stepping up at JV level, staged US government support, project finance backed by offtake, or strategic partners — all workable, but more complex and potentially more dilutive than a single large grant.

- The binary nature of this release and volatility in SLX is why we trimmed our position ~$10.50 in October: Alert Here.

We remain bullish SLX around $7 but it may take time now to trade back above $10. Remember, this is a very high risk/high reward type position, hence our small weighting.