Hi Tony,

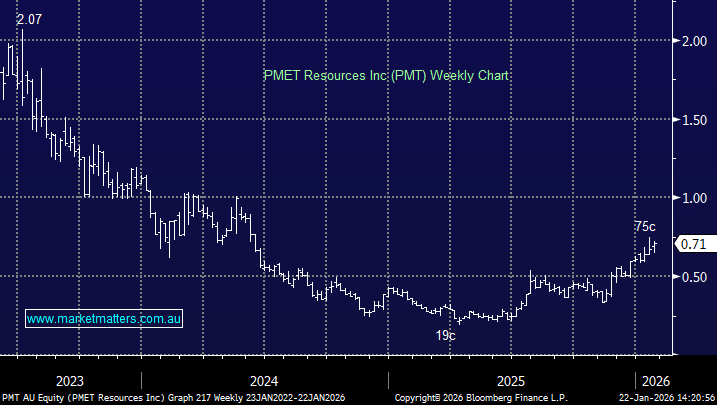

Patriot Battery Metals (PMT) has now changed its name to PMET Resources Inc., but the ticker code remains the same.

In mid-2023, global lithium giant Albemarle (ALB US) invested ~$C109 million (~6.4% of PMT on a non-diluted basis) at $C15.29 per share, which was a premium to market at the time and seen as validation for the company’s Corvette lithium project and its strategic quality. However, the Memorandum of Understanding (MOU) with ALB expired after ~9 months and was not extended, meaning ALB is no longer pursuing the downstream partnership, though the investment itself remains.

NB PMET is dual listed in Australia and Canada.

The ALB stake was well-timed and funded meaningful development work, but the big strategic tie-up that would have driven a material re-rating hasn’t materialised yet. PMET still offers exposure to a significant lithium asset, but the pathway to a major acquisition premium is now more likely to come from future partnerships or production success, not the Albemarle deal itself.

On Thursday PMET announced they’d found wide and high-grade lithium at the Vega zone within its Shaakichiuwaanaan property in Canada sending the stock up +8%. If lithium can continue to advance PMET could become a M&A target but for now this $1.2bn company continues to burn cash and is expected to for at least 3-years, hence it’s not for us at this stage.