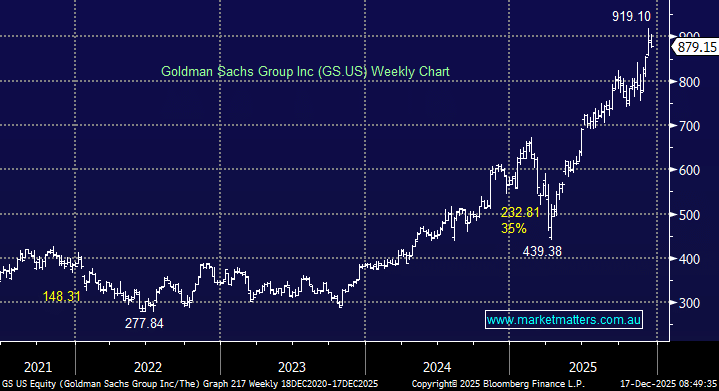

Goldman Sachs has been on an exceptional run, as have most US banks through 2025, with shares up ~53% over the past year and trading near all-time highs. Our position in the International Equities Portfolio is up ~70%, having initiated the position in April.

Over time, share prices follow earnings, and that has clearly been the case for Goldman. However, while earnings growth has underpinned the rally, a material component of the move has come from valuation expansion. GS now trades on ~16x FY25 earnings and ~2.4x book value, placing it at the most expensive valuation in its recent history.

We originally bought Goldman on ~11.2x FY25 earnings, expecting earnings to grow by around 12%. While earnings will likely grow a little faster than that, there has been a clear shift in how the market is valuing the quality and durability of those earnings.

There is no doubt that Goldman has had a standout year operationally. The firm has captured more than its fair share of the resurgence in capital markets activity, leading global league tables for deal flow and benefiting from a more benign regulatory environment.

For context, CBA – often the global poster child for bank overvaluation – still trades on ~24x earnings and ~3.3x book value, despite pulling back ~20% from recent highs. However, the US banking market is far more competitive than Australia, and Goldman operates a more aggressive business model than CBA – one with higher growth potential, but also higher embedded risk.

Looking across peers (Est FY25):

- JP Morgan (JPM US) trades on ~15x

- Morgan Stanley (MS US) on ~16.8x

- Citi (C US) on ~11.2x

- Bank of America (BAC US) on ~12.7x

Within our portfolio, UBS trades on ~13.8x, while ASX-listed Macquarie (not held) trades on around 17x.

Operationally, Goldman continues to fire. The firm has advised on around one-third of all US M&A transactions in 2025, which is shaping up as the second-best year ever for announced deal activity. Importantly, not all announced deals have yet translated into fees, which supports earnings momentum into 2026. Management also sees a strong equity capital markets pipeline, with disruptions from “Liberation Day” and the US government shutdown expected to be fully behind us by year-end.

Looking further ahead, Goldman has highlighted the potential for a reacceleration in sponsor activity, with approximately US$1 trillion in dry powder and US$4 trillion in portfolio company value sitting on private equity balance sheets. The pipeline remains robust.

Alongside revenue momentum, Goldman is running an efficiency program – OneGS 3.0 – aimed at lifting productivity at a time when revenues are already firing. The initiative involves re-engineering six core workstreams and asking employees to re-underwrite human processes across the firm, with a particular focus on better leveraging AI.

We believe banks will be major beneficiaries of the AI revolution, with meaningful scope to reduce costs across a large revenue base. Even modest margin improvements can have a powerful impact on ROE and earnings, which may help explain why the market is now willing to pay materially higher multiples for high-quality banks than in the past.

Goldman Sachs is a phenomenal global franchise, and the stock has been an excellent contributor to portfolio performance this year. However, with every position across Market Matters portfolios, we continuously ask a simple question: would we buy this stock today?

Our market view is evolving, and we increasingly believe the rally will need to broaden away from over-extended winners – a category Goldman now fits into. While momentum remains strong, we view the shares as fully valued at current levels. As such, our bias is to trim the position back to a 4% portfolio weight, from an initial 5% target that has drifted higher as GS has materially outperformed the broader portfolio.