Hi David,

Predictive Discovery (PDI) recently received a binding takeover bid from Perseus Mining Ltd (PRU) who already own 17.78% of PDI. This triggered a competitive situation because PDI was already in an agreement with Robex Resources (RBX CN), a Canadian gold producer.

- Perseus Mining made the binding superior proposal, at the time, of 0.136 Perseus shares for every 1 Predictive share.

Perseus wants PDI to strengthen its West African gold growth pipeline, where both companies already operate. Conversely, Robex’s pitch to PDI shareholders is two-fold. It believes the combined company could, over time, be taken over by the likes of AngloGold, Barrick or China’s Zijin. And that the cashflow from the merged entity could fund the development of PDI’s flagship asset, the Bankan project in West Africa’s Guinea, without needing to raise capital.

- On Thursday morning PRU binding offer ended and PDI have received a revised offer from Robex.

There appears more to play out here, but neither are clear cash bids, in both cases the PDI share price is exposed to the vagaries of the gold price and related shares.

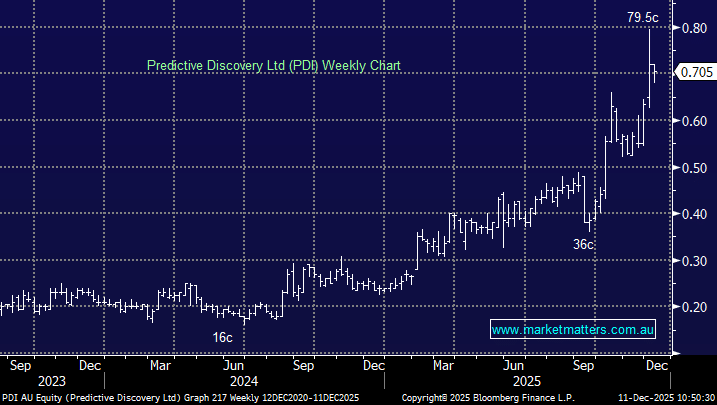

- We remain bullish towards gold and its related stocks into 2026 but wouldn’t be chasing PDI much above 70c preferring others in the sector.