Hi Steve,

Many thanks for the feedback, makes the long days’ worth it!

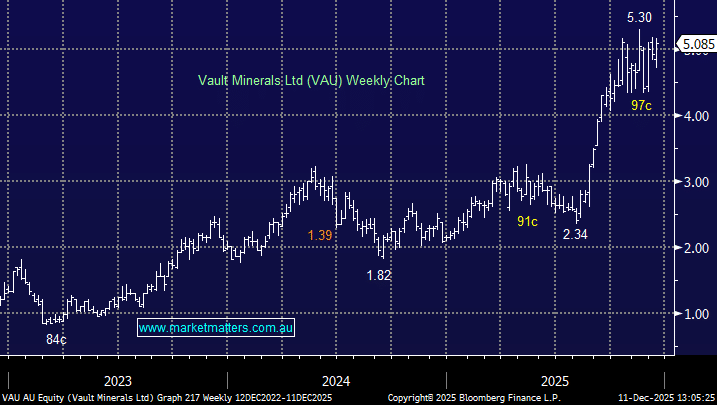

Vault Minerals (VAU) and Genesis Minerals (GMD) both look good in the short term with new highs our preferred scenario, at least 8-10% further upside. In terms of it being “materially unhedged” they have settled and closed all their gold forward sales contracts for the second half of FY26 early, meaning it will receive full spot gold pricing on that production rather than selling at pre-set forward prices. It still has a small percentage of its 2027 production hedged:

- VAU is well positioned if the gold price continues to strengthen into 2026, but the reverse is also true.

In terms of being a target of GMD, some analysts and investors have speculated that VAU could be a takeover target for GMD, given their geographic proximity and complementary assets in the Leonora gold district in Western Australia. However, GMD leadership has publicly denied that a takeover bid is in the works, saying they are focusing on organic growth rather than M&A right now.

In terms of IVE Group (IGL), we expect them to maintain a 9.5c interim dividend and an 8.5c final dividend, putting them on a yield of 6.4% over the next 12-months – we see no reason to doubt they can achieve this.