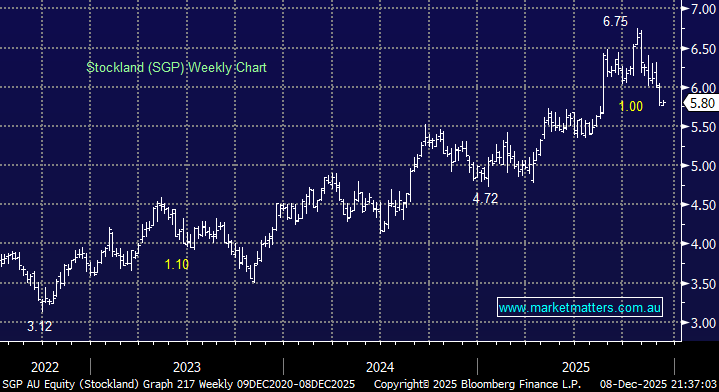

SGP has delivered for investors more than doubling from its 2022 low while paying a healthy dividend along the way – its forecast to yield 4.7% in the coming year. SGP develops and manages a property portfolio across residential, retail, retirement, office and industrial assets but as a business with gearing, a succession of rate hikes should ultimately weigh on profitability. However, its expansion into logistics and data centres could add some spice to the business in the coming years.

Stockland makes most of its money from residential and land-lease development profits, supported by stable recurring rental income from its commercial property portfolio, and supplemented by funds management and development fees. Rising rates are likely to crimp affordability and weigh on their development division, yet the stock is still trading on the rich side of history, more than 15% above its average 5-year valuation, which feels rich to MM, especially ahead of next week’s result.

- We like the risk/reward towards SGP back around $5.50, or 5% lower.