Natural Gas – spot and futures

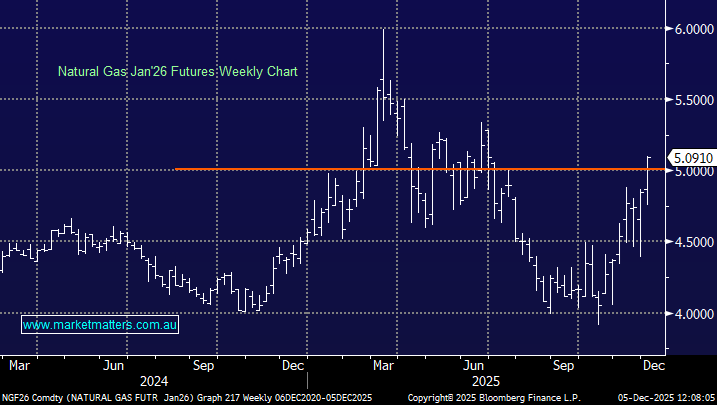

Hi, Merry Christmas, thanks for the ongoing work throughout the year and good luck with the new venture. Another one for your view on American natural gas. Henry hub futures and spot prices The price has gone vertical over the last two months, sitting at multi year highs. Can you give your views and opinions please, as I must be missing some detail. I understand the concept of demand through northern hemisphere winter, along with higher US exports due to Europe coming away from Russian gas and need for more energy and coal phase out, however, from what I can see, supply is higher than ever, inline with demand, storage inventory is above 5 year average, the energy requirements and coal phase out is well known and future prices trending lower across later contracts. I'm actually in a short and sweating on the position I hold on the spot cash price as I'm looking at the massive clear space above $5 if it breaks above; which is looking like a strong possibility even before the weekend. This is one of my worst read trades and have clearly missed something in my analysis. Thanks, Simon