Hi Debbie,

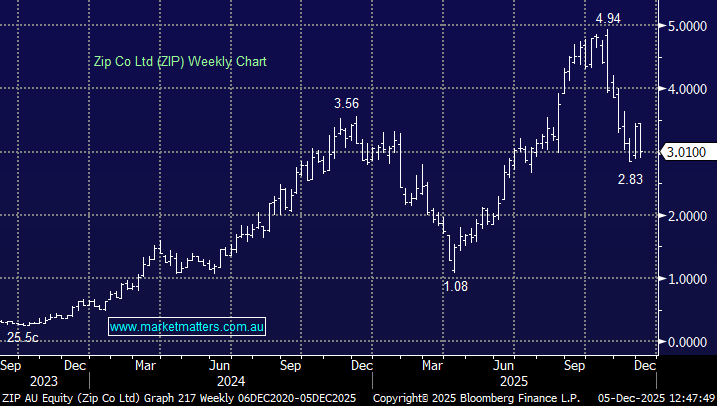

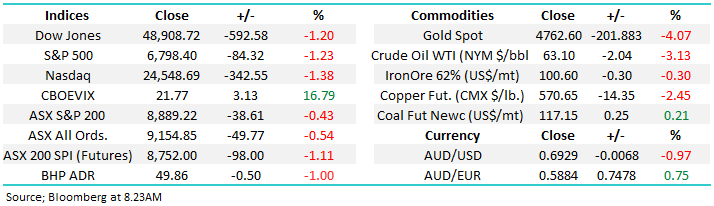

ZIP is still trading around $3, where you can play with the numbers and say it tripled from the April lows or has corrected ~40% from its October high. Also, we note that a number of highly correlated tech/high growth or valuation names have also been under pressure over recent weeks.

However, moving onto the specifics around ZIP: the BNPL industry in the US, including Zip, received an inquiry from State Attorneys General offices – other firms who received letters are Affirm, Afterpay, PayPal, and Sezzle, some big names!

- The inquiry reflects concern that BNPL lenders may not be complying with consumer-protection laws, especially now that a federal rule meant to treat BNPL as “credit” under the same protections as credit cards was withdrawn.

We feel ZIP already maintains stringent policies including relatively tight controls on accounts with missed repayments, but you never know what the ultimate outcome will be.

- The risks cannot be underestimated with ~60% of ZIPs FY25 revenue coming from the US, and importantly most of its growth going forward.

On balance we still believe this uncertainty is creating a buying opportunity in ZIP back ~$3.