Hi Ray,

A great question as the investment landscape continues to evolve, the answer is definitely more than a 2-edged sword. At MM we have recently launched our International Equities Portfolio to satisfy increasing demand. It adds an exciting new dimension to the MM suit of alternatives for investment:

- Basis the end of November the portfolio has delivered +21.99% pa since its inception in June 2019, beating its benchmark by more than +7.5% annually, and outpacing the returns seen in domcetsic shares.

There are a number of pros and cons to weigh up when investing overseas, some of which are listed below but it’s certainly worth considering as stock markets become increasingly global by the month:

- The US tech sector has significantly outperformed the ASX equivalent across all meaningful timeframes.

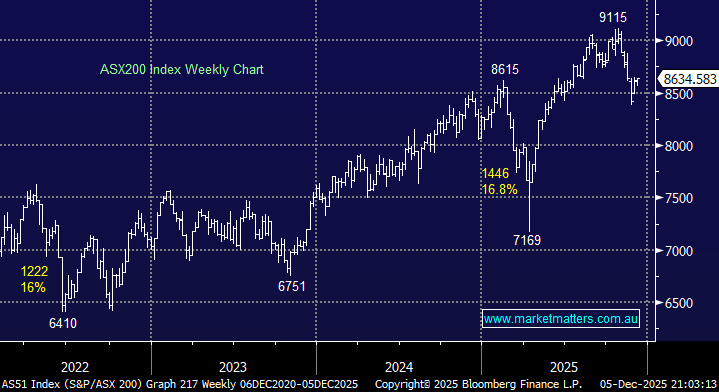

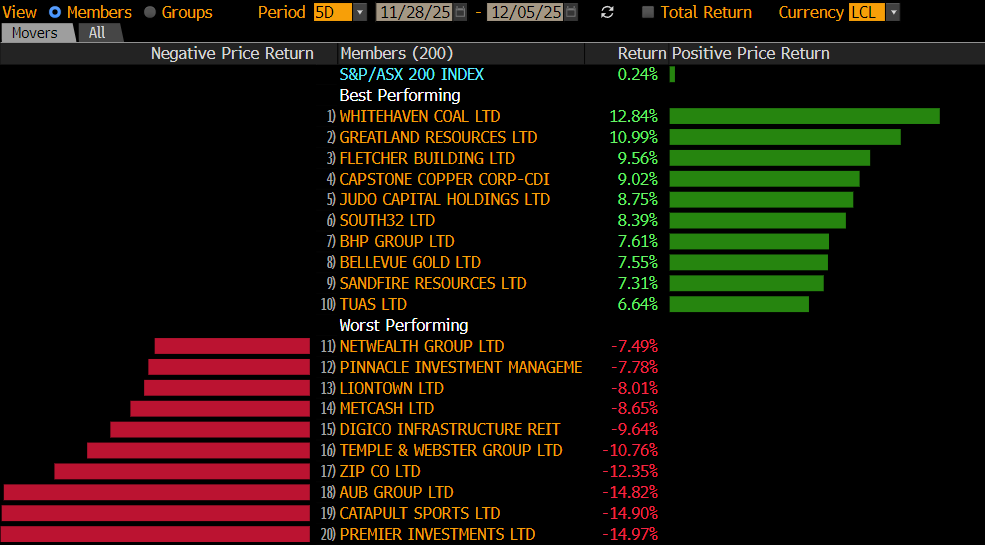

- Conversely the ASX resources are currently in the driving seat as we discussed in an earlier question.

- The US market as a whole yields much lower than the ASX, plus there’s no franking available.

- Lastly, if we are correct the $A is heading ~6% higher, which weighs on unhedged investments in the US for local investors.

We believe Australian investors should certainly consider expanding into overseas markets for added growth optionality, although if income is the primary objective, staying in Australia makes more sense.