Hi David,

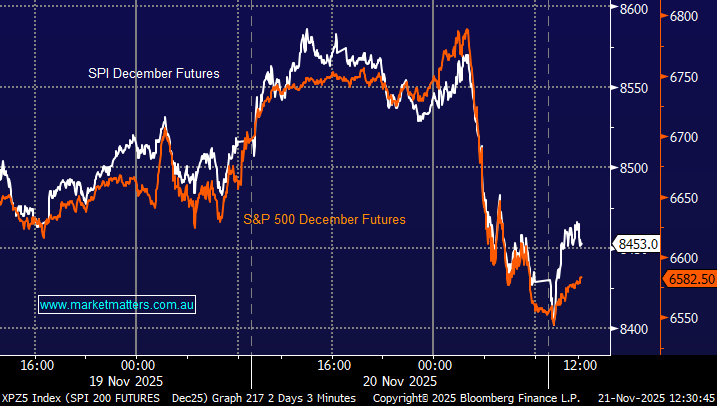

In our view, more than half of large intraday moves on the ASX are driven by fluctuations in U.S. S&P 500 futures, which trade throughout the Australian day. With most U.S. companies reporting after the U.S. market close, investors often reposition ahead of the next session. When you add in market sensitivity to commentary from the White House, it’s easy to see why U.S. futures can swing sharply during their night session — and why those moves spill over into our own market intraday.

- When US Futures swing around arbitrage traders will play the SPI Futures (ASX 200) off against them, i.e. say buy the S&P Futures and sell the SPI.

Also, we often get news flow out of Asia, and particularly China, which can have a meaningful impact on our resources sector and by definition the ASX200.

This intra-day, or even intra-week “noise” should be regarded as opportunity and not frustration. To your point though, the market/traders can be very fickle at times – and daily moves are often more random and hard to pick than medium term trends. Right now, we think this is all sentiment driven with a touch of macro influence (monetary policy uncertainty) – but nothing has materially changed around the earnings outlook – hence, we are not forecasting a deeper, more protracted pullback at this stage. Alan could well be on the money!