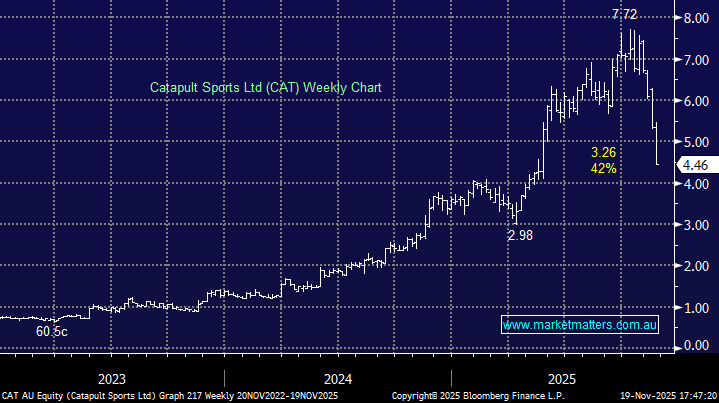

CAT is a $1.4bn sports analytics business that generated $116.5mn in revenue in FY25, and is forecast to lift this to $137.9mn in FY26. They lost $5.2mn in the 1H, however, within that was a $3.5m debt repayment, making them now debt-free, with net cash of $11.3m. The stocks report this week was solid in our view, even though there was a lift in ACV churn to 4.9% (vs 4.3% in 2H25), due to their planned exit from Russia – the stock was hammered!

We covered their recent result in more detail here, with the company guiding to strong ACV growth in 2H26, lower underlying churn once Russia rolls out of the base and flagged positive momentum in professional team onboarding, with FY26 Free Cash Flow expected to exceed FY25’s $8.6m. The global sports analytics market is projected to grow to around $21bn by 2030, illustrating the potential for CAT. However, there remains a lot of growth priced into its valuation with the next 10-20% move in the stock likely to driven by market sentiment.

- We believe that CAT remains a high-quality global SaaS business with improving cash flow, a strengthening balance sheet, and clear operating leverage – MM owns CAT in its Emerging Companies Portfolio.