Hi Paul,

This is a very good question, and worth spending a bit more time on than usual;

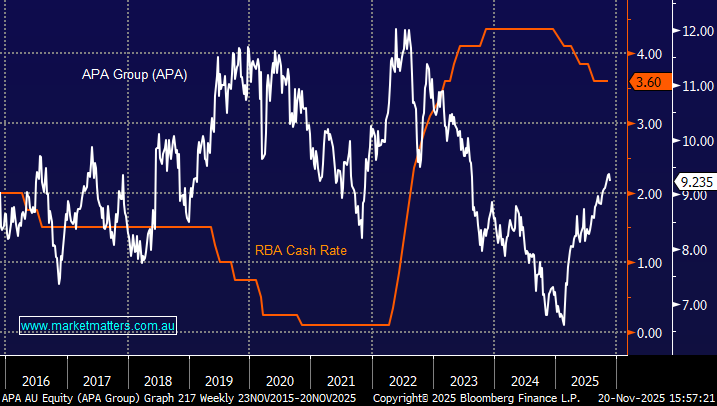

APA Group (APA): As the chart below illustrates, APA has a broad correlation with cash rates. Rising rates are a negative, falling rates are a positive, though it’s clearly not a perfect science as was obvious during the period 2019-21.

We would caution being too glued to analysts’ expectations, there are 2 Buys, 7 Holds, and 2 Sells on APA with a Price Target (PT) of $8.68, not far away after APA’s expected 27.5c dividend in December. The stock like many across the market has performed well of late as a defensive, delivering sustainable earnings and yield while value compression has hit the growth sector.

The main risks are APA still derives most of its revenue from gas transmission. As Australia shifts toward electrification, renewables and decarbonisation, gas volumes may fall over time — raising the risk of under-utilised pipelines or stranded assets – but that is unlikely to be the case in the coming years. We are also concious that APA is a capital-intensive, highly geared infrastructure business. Rising interest rates or tighter credit conditions directly increase borrowing costs, reduce returns on new projects, and pressure cashflows making this a clear risk factor.

However, as the world evolves, it should come as no surprise that APA is pivoting toward multi-fuel transmission, planning to repurpose some gas pipelines for hydrogen transport in the future. APA look capable of funding their development pipeline without cutting the dividend, which had been a concern of the market, hence the share price has continued to accelerate higher. In terms of growth in yield, we are only expecting ~2% annual growth over the next couple of years.

With regard to bond yields (interest rates), APA’s yield spread over 10 year yields is our primary indicator on this stock. With US 10’s (global benchmark for rates) at 4.05%, the current spread is 2.2% (APA yield exp at 6.25%). The margin had been well over 3%, but has been below 2% on multiple occasions in years gone by. At 2.2% it is getting slim, our triggger point would be a move sub 2% – we think that ‘risk’ margin would be getting too low.

- While we own APA in our Active Growth and Income Portfolios, we now see less growth upside in this holding, and have it earmarked as a funding vehicle in the growth portfolio in the first instance.

Dalrymple Bay Infrastructure Ltd (DBI): the stock firmed on Tuesday when most other stocks ran for cover but like APA it’s a reliable defensive, set to yield ~5.6% over the coming 12-months. This is the sort of stock that fits perfectly in our Income Portfolio, where lower beta, higher yield, and greater predictability in returns are central. By weighting a portfolio towards these sorts of stocks, combined with fixed income exposures, it creates a very nice risk adjusted return profile, in our view. To put some numbers around this, the Income Portfolio has had a maximum drawdown this financial year of 2% – which has occured between 12th – 21st November (i.e. now). This is against a market that has pulled back 7.7%, and for context, our Growth Portfolio has pulled back 7%.

DBI have guided to dividend growth between 3-7% per annum for the foreseeable future, based on paying out 60-80% of Funds from Operations (FFO). We have 5% pa dividend growth in our forecasts, underpinned by take or pay contracts that ratchet up each year, supportive of DBI’s role as a solid dividend-paying infrastructure stock.

The reason the price has been ‘cappped’ is due to Brookfields sell down which has satisfied a lot of natural demand that would have occured on market. It may take a while for it to push meaningfully above $4.50, though, share prices follow earnings over time, and we have a degree of conviction that DBI will continue to grow earnings – the share price will follow.

- DBI is a pure-play met coal infrastructure asset, so long-term risks post 2035 are real, but at this stage, we don’t believe the risks you highlight will become an issue for the next 5-10 years.