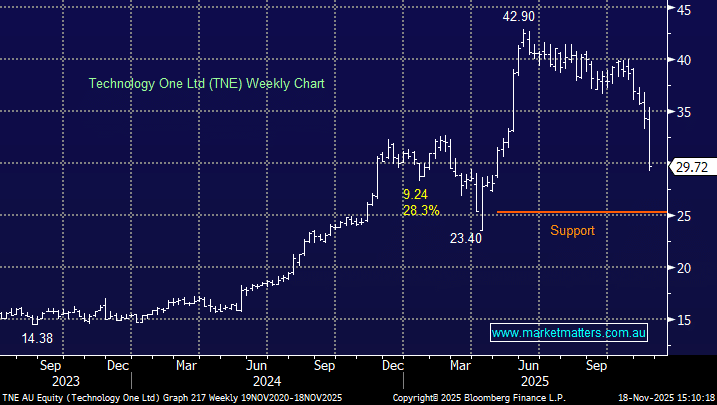

TNE was smacked over 17% on Tuesday after reporting annual recurring revenue (ARR) below expectations and providing no FY26 guidance, compounding tech sector-wide weakness. TNE has been one of the most reliable performers among Australia’s listed tech sector for more than 25 years, with its software used to run universities, government departments and local councils, but on Tuesday, it embraced the if in doubt, sell mood across ASX tech.

- The company said annual recurring revenue (ARR), a key measure of growth, reached $554.6 million in the year, up +18%, but below the market’s expectations for +21% growth.

- For the full year, total revenue increased 18% to $610mn while its net profit jumped 17% to $137.6mn – not awful numbers but light on growth.

- A “sweetener” special dividend of 10¢ per share failed to impress investors who focused on the ARR – a common theme this year.

NB Annual Recurring Revenue (ARR) defines growth by showing how much predictable, subscription-based revenue a business generates each year, with growth being measured by how much this ARR increases over time through new customers, upgrades, and reduced churn.

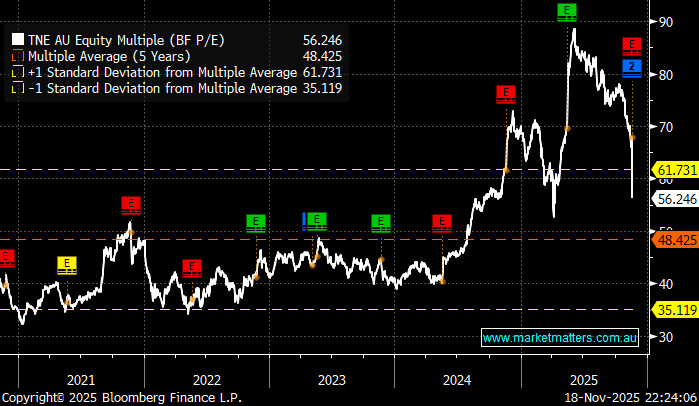

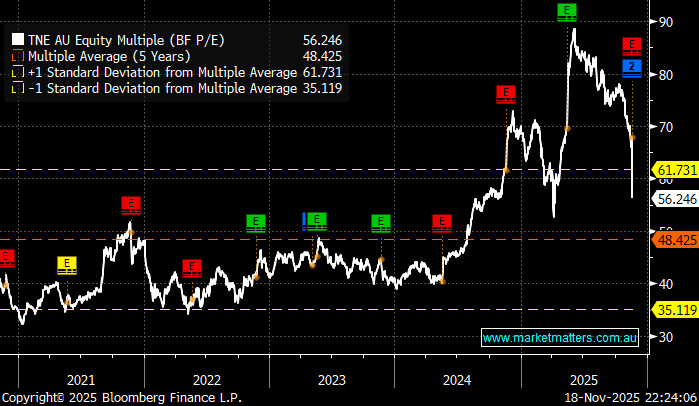

The Rule of 40 says a tech company is healthy if its revenue growth plus profit margin is at least 40%. The rule is an important measure for subscription software businesses where revenue growth and profitability, as a percentage, should add up to more than 40. TNE reported a score of 59, but the disappointing ARR number was front and centre on the day, causing TNE to experience its worst session in nearly 23 years. The obvious question is whether the degree of weakness is justified, although we must be conscious that the market is currently contracting the valuation premium of growth stocks across the board.

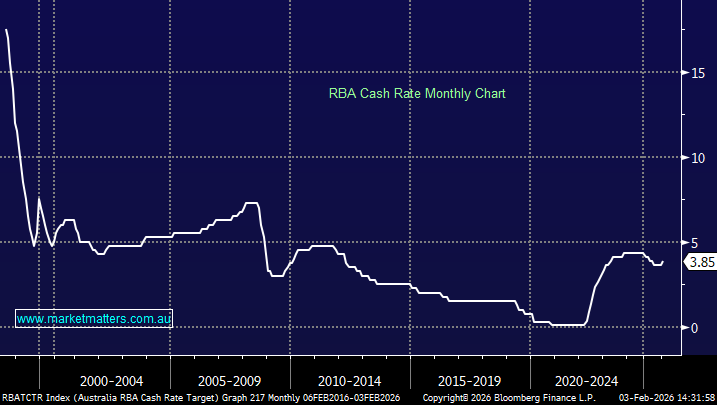

Valuation contraction has been painful across the ASX tech sector, significantly worse than in the US, with the local sector down 17.3% in November compared to the S&P 500 tech sector, which has slipped just 6.3%, remaining above its October low.

- How some of the local “big tech” names now stack up compared to their 5-year average PE valuation: TNE +17%, WTC -42%, Life360 -48%, and XRO -54%.

With ARR disappointing and TNE remaining on the expensive side, the stock currently doesn’t appear compelling value compared to its peers that have largely followed through after initial weakness over recent weeks.

TNE’s result was not all bad news though, with total revenue up 18% hence the stock should still be priced for growth with the question being how much. One of the issues again is that TNE is already a relatively popular stock, with only one SELL out of 17 analyst ratings, and that may be tweaked with the stock trading below $30. We continue to like how TNE is expanding globally with its UK SaaS+ platform implemented by more than 50 local councils. Importantly, the business still looks to be on the right track to achieve management’s target of ~$1 billion in ARR by FY30, and this morning we’ve seen upgrades from both Morgan Stanley and JP Morgan to buy equivalents.

- We like TNE as a business, however the follow through selling that has emerged in other tech stocks that disappoint will keep us on the sidelines in the short term – we would get more positive on a move towards ~$25