Hi Sidney,

We have discussed DroneShield (DRO) earlier in today’s report. At $2.30 its now trading on 44x estimated for CY25 earnings, which drops to 29x FY26 consensus numbers due to strong growth. The director sell-down clearly spooked markets – as it should have, but these sorts of big washouts can be goood opporrtunities. We think DRO is a high risk buy after this weeks agressive rout.

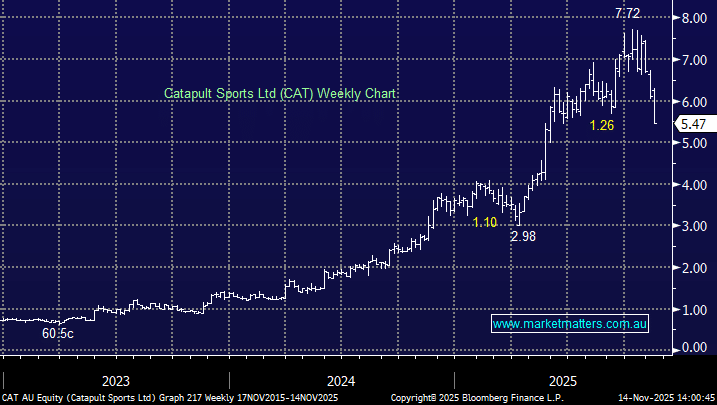

We trimmed our position in CAT above $7 in October, Alert here, in anticipation of a pullback but we didn’t want to lose our position to a company that MM still believes has significant upside. The current pullback is not dissimilar to what’s happened across a number of high growth ASX stocks in recent weeks, albeit in an amplified fashion akin to its explosive rally. We see value in CAT at current levels and would view it as an accumulate.

As for Interactive brokers and Linkhome (LHAI US) like other regulated brokers, they can temporarily or permanently restrict buying of certain stocks for several practical or regulatory reasons. In this case it might be the relatively low volume traded, but we also would recommend checking your W-8Ben form is up to date. If your US tax form has expired, that can prompt restriction in making new buys.