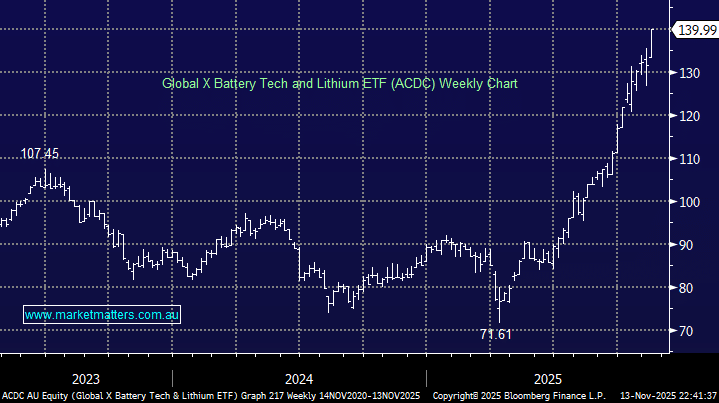

The lithium sector has roared higher from its April lows as the underlying battery metal traded back towards $1,000US/MT after testing $US600 earlier in the year. The impact has been dramatic on related stocks, with many suddenly approaching, or having reached, viability as the price rises. The combination of the increased rate of EV purchases and increasingly bullish estimates of surging demand for battery storage due to AI have been the catalyst for the advance, and while these are very real macro drivers, there is now a lot built into the market short term, especially with plenty of supply waiting to come out of mothballs at higher prices. Conversely, Mineral Resources’ (MIN) deal with POSCO this week, and Pilbara’s (PLS) openness to a similar tie-up is very supportive, as we have companies “in the know” wanting to increase their exposure to the future of lithium. The ASX-listed ACDC ETF is a good vehicle to get exposure to the lithium sector:

- The ETF holds 39 stocks, with its 5 largest positions currently Eos Energy, Canadian Solar, Delta Electronics, Liontown Resources, and HD Hyundai – Mineral Resources is 6th with a 4.1% weighting.

- From a regional perspective, it has 16% exposure to Japan, followed by 16% to the US, 12% Australia, and 10% South Korea.

- It has a modest market cap of $680mn, while its fees are okay at 0.69%.

The investment objective of ACDC ETF is to provide investors with exposure to companies throughout the lithium cycle, including mining, refinement and battery production – its correlation to the likes of MIN, PLS and LTR is pretty good.

- We can see the bull market extending higher, but a pullback/period of consolidation feels overdue.