We almost began with gold this morning — after all, precious metals have dominated headlines in recent months — but lithium has taken centre stage of late. In October, the precious metals market underwent a major shakeout, clearing out many weak longs and speculative positions as the crowded trade unwound in a classic panic. In a single session, spot gold plunged as much as 6.3%, its sharpest one-day fall in over a decade, while spot silver tumbled 8.7%, despite no specific catalyst.

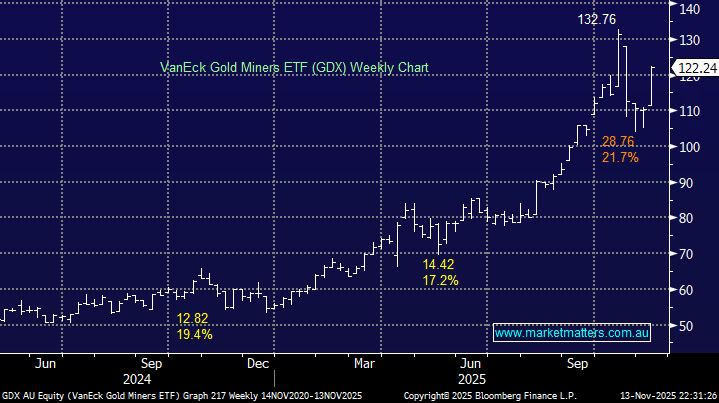

Normality appears to have returned to the gold market, with central banks still buying Gold and its day-to-day moves being driven by short-dated credit markets and traders’ perception of the path of Fed interest rate cuts. Whenever doubts creep into the market that Jerome Powell will cut rates at least three times by next Christmas, the precious metal struggles, as it did last night. The ASX-traded GDX ETF is an excellent vehicle to gain exposure to global gold stocks:

- The ETF holds 86 stocks, with its 5 largest positions currently Newmont, Agnico Eagle Mines, Barrick Mining, Wheaton Precious Metals, and AngloGold.

- From a regional perspective, it has 51% exposure to Canada, followed by 18% to the US, 11% Australia, and 7% South Africa.

- It has a large $1.4bn market cap, backed up by $US23.9bn in its US parent, while its fees are a reasonable 0.53%.

We expect a choppy ride over the coming weeks, but MM believes the underlying bull market is alive and well in Gold.

- We are looking for the GDX ETF to ultimately test the $140 area over the coming months.