Hi Steve,

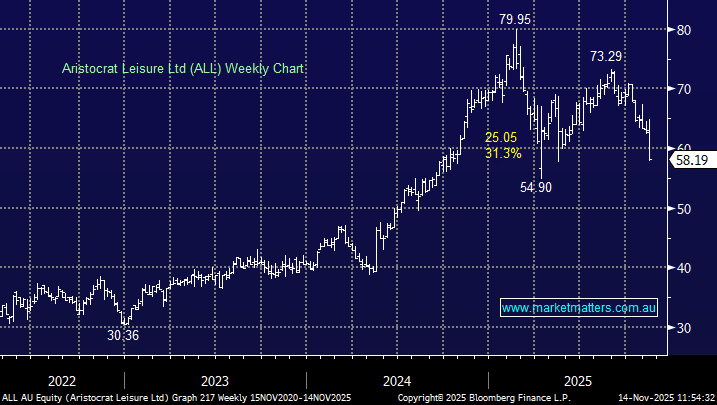

ALL has been dealt with fairly harshly after this week’s report, like many ASX names in recent weeks – on Friday morning, the stock was trading down ~7% for the week. However, we should note that it’s been a tough week for the ASX, and high valuation/growth names have been at the forefront of the selling. The result looked good on the surface, but the devil is in the details.

While earnings from its land-based gaming segment were solid, growth in its Interactive segment (digital/mobile gaming arm, run under Pixel United) was the issue. This is what will drive future growth for ALL, and it failed to live up to expectations.

This business, which generates revenue from in-app purchases and advertising, has become a key growth engine alongside its traditional slot-machine operations, now accounting for around one-third of group revenue. The sell-off may feel severe but ALL has only retraced back to its average valuation of the last few years. We wouldn’t be surprised to see further underperformance as the market digests a slowdown in the area it hoped would generate better growth.