Hi Sue,

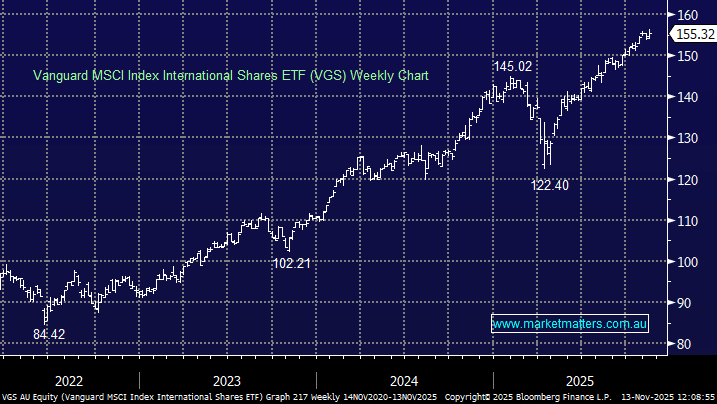

The Vanguard MSCI Index International Shares ETF (VGS) provides relatively cheap (0.18%) exposure to around 1,300 companies across developed countries (excluding Australia) such as the U.S., Japan, U.K., Canada, France and Switzerland – a great start.

We may be a bit pro-Australia, but we would also flag an allocation to Australian Equities. One way to do that, could be combining this with a broad/cheap listed investment company such as Argo (ARG). We highlight this becuase ARG is currently trading at a ~13% discount to NTA, which in our view, is offering some decent value.

Potentially a mix of the two would provide great global exposure and hopefully generate some interest in wealth creation, with the latter idea bringing up the concept of buying undervalued assets – a good lesson to learn early on in the investing journey.